A) $63,000

B) $85,000

C) $65,000

D) $83,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct exchange of debt for equipment would be shown:

A) on the statement of cash flows as an operating activity.

B) on the statement of cash flows as an investing activity.

C) on the statement of cash flows as a financing activity.

D) as a supplementary disclosure to the statement of cash flows.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from financing activities include all of the following except

A) payment of long-term debt.

B) interest expense.

C) proceeds from stock issuance.

D) dividends paid to stockholders.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If insurance expense is $7,000 and the beginning and ending balances of prepaid insurance are $1,500 and $2,000,respectively,the cash paid for insurance is

A) $7,000

B) $6,500

C) $5,000

D) $7,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2014,a company paid $4,500 which it owed from its 2013 income tax liability and $30,000 for its 2014 tax liability.The company still owes $6,000 at year-end.How much should the company report as cash paid for income taxes on its 2014 statement of cash flows,using the direct method?

A) $34,500

B) $40,500

C) $30,000

D) $3,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represent cash provided by financing activities?

A) Issuing stock in exchange for another company's stock.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Receiving interest on promissory notes.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When preparing the operating activities section of the statement of cash flows using the indirect method,an increase in income taxes payable is added to net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be considered cash and cash equivalents for purposes of preparing a statement of cash flows?

A) Money market funds.

B) Checking accounts.

C) Treasury bills.

D) Notes receivable.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the first step in calculating cash flows from operations when the indirect method is used?

A) Find net income on the income statement.

B) Calculate the net change in the cash account.

C) Add the change in accounts receivable to sales revenue.

D) Identify the balance sheet accounts that relate to operating activities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.What is the amount of cash paid for rent?

A) $9,000

B) $11,000

C) $10,000

D) $12,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items would be reported on a statement of cash flows using the indirect method,but not on a statement prepared using the direct method?

A) Cash paid for dividends.

B) Cash received from stock issuances.

C) Depreciation expense.

D) Cash paid for purchase of treasury stock.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the direct method is used to determine the cash flows from operating activities,other operating expenses are converted into cash outflows by:

A) adding changes in prepaid expenses and accrued liabilities to other expenses.

B) subtracting increases in prepaid expenses and subtracting decreases in accrued liabilities from other expenses.

C) adding increases in prepaid expenses and adding decreases in accrued liabilities to other expenses.

D) subtracting changes in prepaid expenses and accrued liabilities from other expenses.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represent cash outflows from financing activities?

A) Distributing a stock dividend.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Paying interest on promissory notes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Negative operating cash flow may indicate all of the following except:

A) the company may not be able to replace property,plant and equipment.

B) stockholders may not receive a dividend.

C) the company may be in the introductory phase of its life cycle.

D) The company did not earn a profit from its core business activity.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true regarding cash flows from financing activities?

A) When companies borrow,cash outflows for financing activities have occurred.

B) When companies receive dividends,cash inflows from financing activities have occurred.

C) When companies repurchase their own stock,cash outflows for financing activities have occurred.

D) When companies pay dividends,cash inflows from financing activities have occurred.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company issues $1 million of new stock and pays $200,000 in cash dividends during the year.In addition,the company took advantage of falling interest rates to borrow $1.5 million in a new bond issue and paid off existing bonds with a face value of $2 million.The company bought 500 of another company's $1,000 bonds at a $100,000 premium.The net cash flow from financing activities is:

A) An inflow of $500,000.

B) An outflow of $200,000.

C) An outflow of $100,000.

D) An inflow of $300,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.What was the amount of cash paid for purchases of equipment during the year?

A) $40,000

B) $43,000

C) $50,000

D) $31,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company owned equipment with a book value of $120,000 that was sold during this accounting period for $30,500 in cash,and purchased new equipment for cash of $148,000.Your company would record:

A) a debit of $148,000 and a credit of $30,500 to the cash account for a net cash inflow of $117,500.

B) a debit of $148,000 and a credit of $89,500 to the cash account for a net cash inflow of $58,500.

C) a debit of $30,500 and a credit of $148,000 to the cash account for a net cash outflow of $117,500.

D) a debit of $89,500 and a credit of $148,000 to the cash account for a net cash outflow of $58,500.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

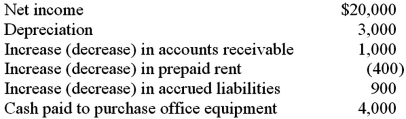

Consider the following information:  The company would report net cash provided by operating activities of:

The company would report net cash provided by operating activities of:

A) $17,500.

B) $18,500.

C) $21,500.

D) $23,300.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a net cash inflow from operating activities of $789,000,a net cash outflow of $50,000 from investing activities and a net cash inflow of $100,000 from financing activities.The company paid $124,000 in interest,$186,500 in income taxes,and $200,000 in dividends.Which of the following statements about the statement of cash flows is not true?

A) Dividends of $200,000 will be reported as a cash outflow in the cash flow from investing activities section.

B) Supplemental disclosures required for a company using the indirect method include the amount of interest and the amount of income taxes paid.

C) The statement of cash flows will show a net increase to cash and cash equivalents of $839,000.

D) If the direct method is used,the $124,000 of interest paid and the $186,500 of income taxes paid will be reported in the cash flows from operating activities.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 147

Related Exams