A) reduce taxes by $160 billion.

B) increase government spending by $80 billion.

C) reduce taxes by $40 billion.

D) increase government spending by $40 billion.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

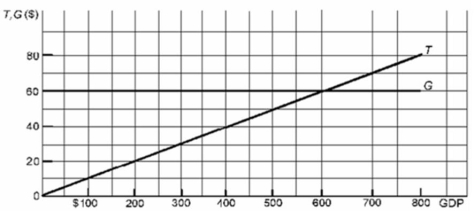

Refer to the above diagram where T is tax revenues and G is government expenditures.All figures are in billions of dollars.If the full-employment GDP is $400 billion while the actual GDP is $200 billion, the cyclical deficit is:

Refer to the above diagram where T is tax revenues and G is government expenditures.All figures are in billions of dollars.If the full-employment GDP is $400 billion while the actual GDP is $200 billion, the cyclical deficit is:

A) $40 billion.

B) $20 billion.

C) zero.

D) $60 billion.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Actions by the Federal government that decrease the progressiveness of the tax system:

A) decrease the amount of government spending.

B) increase the effects of automatic stabilizers.

C) decrease the effects of automatic stabilizers.

D) increase the amount of taxation.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following phases of a business cycle generates cyclical deficit (a movement from a surplus to a deficit) as a by-product?

A) Recession

B) Trough

C) Expansion

D) Peak

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of a built-in automatic stabilizer for the Canadian economy is:

A) the tax system.

B) the market interest rate.

C) consumption expenditure.

D) investment spending.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using Image 13.2 Global Perspective, which of the following countries had the lowest public debt as a percentage of GDP in 2015?

A) France

B) Belgium

C) Spain

D) Canada

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Some economists believe the budget deficit is directly linked to the trade deficit through real interest rates and the international value of the dollar.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above graph.The crowding-out effect would be illustrated by a:

Refer to the above graph.The crowding-out effect would be illustrated by a:

A) shift from curve A to curve B leading to a decrease in investment.

B) shift from curve B to curve A leading to a decrease in interest rates.

C) movement from point 1 to point 2 on curve A leading to a decrease in investment.

D) movement from point 2 to point 1 on curve A leading to a decrease in investment.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an aggregate demand and aggregate supply graph, an expansionary fiscal policy can be illustrated by a:

A) leftward shift in the aggregate demand curve.

B) rightward shift in the aggregate demand curve.

C) leftward shift in the aggregate supply curve.

D) change in the price level.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal budget deficit is calculated each year by:

A) subtracting government spending from government revenues.

B) subtracting consumption and investment from government spending.

C) adding up consumption, investment, government purchases, and net exports.

D) adding up the difference between government revenues and spending over the years of the nation's existence.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cyclical surplus (movement from a deficit to a surplus) is a by-product of what stage of the business cycle?

A) Recession

B) Trough

C) Expansion

D) Peak

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists refer to a budget deficit which exists when the economy is achieving full employment as a:

A) cyclical deficit.

B) surplus in the full-employment budget.

C) natural deficit.

D) cyclically adjusted deficit.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The crowding-out effect arises when:

A) government borrows in the money market, thus increasing interest rates and net investment spending in the economy.

B) government borrows in the money market, thus increasing interest rates and decreasing net investment spending.

C) the progressivity of the tax system increases, thus decreasing interest rates and increasing net investment spending.

D) the progressivity of the tax system decreases, thus decreasing interest rates and net investment spending.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In Year 1, the actual budget deficit was $150 billion and the cyclically adjusted deficit was $125 billion.In Year 2, the actual budget deficit was $125 billion and the cyclically adjusted deficit was $100 billion.It can be concluded that fiscal policy from Year 1 to Year 2 was:

A) proportional.

B) progressive.

C) contractionary.

D) expansionary.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The crowding-out of investment may be avoided if a budget deficit is financed by issuing new money.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following might offset a crowding-out effect of an increase in government spending financed through expansion of the public debt?

A) a decline in net exports

B) an improvement in business profit expectations

C) a decrease in the money supply

D) a decline in public investment

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you are told that the government had an actual budget deficit of $50 billion, then you would:

A) know that fiscal policy was expansionary.

B) know that fiscal policy was contractionary.

C) know that fiscal policy was producing a cyclical deficit.

D) not be able to determine the direction of fiscal policy from the information given.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the economy is in the midst of a severe recession.Which of the following policies would be consistent with discretionary fiscal policy?

A) a Parliamentary proposal to incur a federal surplus to be used for the retirement of public debt

B) a reduction in agricultural subsidies and veterans' benefits

C) a postponement of a highway construction program

D) a reduction in federal tax rates on personal and corporate income

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the best example of public investment?

A) salaries of members of Parliament

B) government expenditures on paper clips

C) construction of highways

D) funding of regulatory agencies

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Contractionary fiscal policy will do what to the government budget, assuming that was balanced at the start?

A) A budget deficit

B) A budget surplus

C) An increase in interest rates

D) A decrease in personal taxes

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 234

Related Exams