A) The discounted payback is five years

B) PI = 0

C) NPV = $0

D) IRR = 15%

E) The present value of the future cash flows equals the initial outlay

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The crossover point is useful when trying to determine:

A) Whether you should accept or reject an independent project.

B) Whether two independent projects are acceptable.

C) Which one of two mutually exclusive projects should be accepted.

D) The rate of return which should be applied to an independent project.

E) The rate of return which should be applied to a mutually exclusive project.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

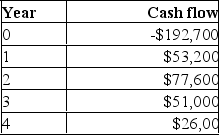

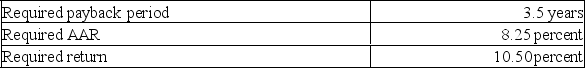

You are analyzing a project and have prepared the following data:

Based on the profitability index of _____ for this project, you should _____ the project.

Based on the profitability index of _____ for this project, you should _____ the project.

A) 0.87; accept

B) 0.87; reject

C) 1.02; accept

D) 1.02; reject

E) 1.08; reject

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculate the NPV of the following project using a discount rate of 12%: Yr 0 = -$500; Yr 1 = -$50; Yr 2 = $50; Yr 3 = $200; Yr 4 = $400; Yr 5 = $400

A) $15.00

B) $61.22

C) $118.75

D) $208.04

E) $269.21

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Deciding which product markets to enter is a capital budgeting decision.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the IRR of an investment that costs $77,500 and pays $27,500 a year for four years?

A) 16%

B) 18%

C) 20%

D) 22%

E) 24%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

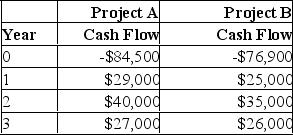

You are analyzing the following two mutually exclusive projects and have developed the following information. What is the crossover rate?

A) 11.113 %

B) 13.008 %

C) 14.901 %

D) 16.750 %

E) 17.899 %

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payback rule can be best stated as:

A) An investment is acceptable if its calculated payback period is less than some pre-specified number of years.

B) An investment should be accepted if the payback is positive and rejected if it is negative.

C) An investment should be rejected if the payback is positive and accepted if it is negative.

D) An investment is acceptable if its calculated payback period is greater than some pre-specified number of years.

E) An investment is acceptable if its calculated payback period is equal to its deprecation useful life.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Floyd Clymer is the CFO of Bonavista Mustang, a manufacturer of parts for classic automobiles. Floyd is considering the purchase of a two-ton press which will allow the firm to stamp out auto fenders. The equipment costs $250,000. The project is expected to produce after-tax cash flows of $60,000 the first year, and increase by $10,000 annually; the after-tax cash flow in year 5 will reach $100,000. Liquidation of the equipment will net the firm $10,000 in cash at the end of five years, making the total cash flow in year five $110,000. Assume the required return is 15%. What is the project's net present value?

A) ($4,950)

B) $12,001

C) $12,623

D) $13,853

E) $15,226

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Project A and B have 4 year timelines. Project A has an initial investment of $100,000 and cash inflows of $60,000, $50,000 $40,000 and $40,000. Project B has an initial investment of $75,000 and cash inflows of $50,000, $40,000, $30,000 and $30,000. At what rate of interest would a company be indifferent at choosing project A or B?

A) 17.95%

B) 19.01%

C) 21.86%

D) 23.88%

E) 24.44%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project costs $12,500 to initiate. Cash flows are estimated as $2,500 a year for the first two years and $3,100 a year for the next three years. The discount rate is 11.25%. The net present value for this project is _____ and the internal rate of return is _________ the discount rate.

A) -$2,138.52; more than

B) -$2,138.52; less than

C) $1,800.00; more than

D) $1,800.00; less than

E) $2,138.52; less than

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

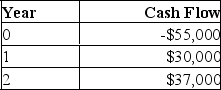

You would like to invest in the following project.  Victoria, your boss, insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted. She also insists on applying a 10 % discount rate to all cash flows. Based on these criteria, you should:

Victoria, your boss, insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted. She also insists on applying a 10 % discount rate to all cash flows. Based on these criteria, you should:

A) Accept the project because it returns almost $1.22 for every $1 invested.

B) Accept the project because it has a positive PI.

C) Accept the project because the NPV is $2,851.

D) Reject the project because the PI is 1.05.

E) Reject the project because the IRR exceeds 10 %.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average accounting return is defined as the:

A) Present value of a project's cash flows divided by the average book value of the project's assets.

B) Present value of a project's cash flows divided by the initial investment in the project.

C) Net income derived from a project divided by the initial investment in the project.

D) Average net income derived from a project divided by the initial investment in the project.

E) Average net income derived from a project divided by the average book value of the project's fixed assets.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct concerning the payback period?

A) An investment is acceptable if its calculated payback period is less than some pre-specified period of time.

B) An investment should be accepted if the payback is positive and rejected if it is negative.

C) An investment should be rejected if the payback is positive and accepted if it is negative.

D) An investment is acceptable if its calculated payback period is greater than some pre-specified period of time.

E) An investment should be accepted any time the payback period is less than the discounted payback period, given a positive discount rate.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shawn's Health Care is considering a project which will produce sales of $1.7 million a year for the next ten years. The profit margin is estimated at 8 %. The project will cost $2.9 million and will be depreciated straight-line to a zero book value over the life of the project. Shawn's has a required accounting return of 9 %. This project should be _____ because the AAR is _____.

A) Accepted; 8.44 %

B) Accepted; 9.38 %

C) Accepted; 9.82 %

D) Rejected; 8.44 %

E) Rejected; 9.38 %

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a project is assigned a required rate of return equal to zero, then:

A) The timing of the project's cash flows has no bearing on the value of the project.

B) The project will always be accepted.

C) The project will always be rejected.

D) Whether the project is accepted or rejected will depend on the timing of the cash flows.

E) The project can never add value for the shareholders.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

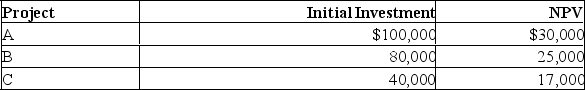

You are considering the following projects but have limited funds to invest and can't take them all. Using the profitability index, rank the projects in the order in which you would accept them. That is, rank them from best to worst.

A) A, BC

B) B, CA

C) C, AB

D) C, BA

E) A, CB

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Desiree, Inc. is considering adding a new product with a start-up cost of $540,000. This cost will be depreciated over 3 years, which is the estimated life of the product. Desiree has a 34% marginal tax rate. The net income for each of the three years is estimated at $15,000, $45,000, and $80,000. What is the average accounting return for the new product?

A) 8.64%

B) 11.30%

C) 17.28%

D) 21.00%

E) 25.93%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Annmarie is considering a project which will produce cash inflows of $1,200 a year for 6 years. The project has a 15 % required rate of return and an initial cost of $3,400. What is the discounted payback period?

A) 2.83 years

B) 2.92 years

C) 3.96 years

D) 3.99 years

E) 4.13 years

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

_______________ is the focus of corporate finance as it is concerned with making the optimal choice between project alternatives.

A) Capital budgeting.

B) Capital structure.

C) Payback period.

D) Short-term budgeting.

E) Capital Allocation.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 341 - 360 of 415

Related Exams