A) $100,000

B) $300,000

C) $400,000

D) $0

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following could result in a corporation having more than 100% of its income subject to state taxation?

A) Some of the states in which the corporation conducts business have not adopted the Uniform Division of Income for Tax Purposes Act formula.

B) The states in which the corporation conducts business have adopted different definitions of the specific components of the UDITPA formula.

C) Some of the states in which the corporation conducts business strictly apply the UDITPA formula while others double-weight the sales factor.

D) All of these factors could result in a corporation having more than 100% of its income subject to state taxation.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following activities create state income tax nexus?

A) Selling products over the Internet to customers in the state.The products are delivered by U.S.mail.

B) Traveling salespersons soliciting orders for tangible goods from customers in the state.

C) Ownership of manufacturing and distribution facilities within the state.

D) All of the above activities create state income tax nexus

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The UDITPA formula for state income tax apportionment consists of three factors: sales,payroll,and profit.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For dividends received prior to 2018,the deemed paid foreign tax credit treats a U.S.corporation that receives a foreign source dividend as if the corporation paid tax directly to a foreign jurisdiction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The UDITPA formula for apportioning income among states is based on four equally weighted factors.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The United States taxes its citizens on their worldwide incomes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Excess foreign tax credits can only be carried to future tax years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

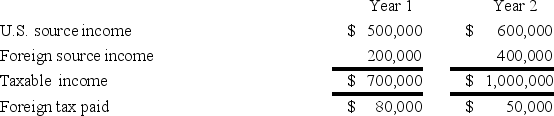

Jenkin Corporation reported the following for its first two taxable years.Assume that the tax rates for both the years are the same.  Calculate Jenkin's U.S.tax liability for Year 2.

Calculate Jenkin's U.S.tax liability for Year 2.

A) $78,000

B) $160,000

C) $132,000

D) $210,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Orchid Inc.,a U.S.multinational with a 21% marginal tax rate,owns a foreign subsidiary operating in a country with a 15% income tax.This year,the subsidiary generated $400,000 taxable income.What is the total tax burden (domestic and foreign) on the earnings of the foreign subsidiary if it does not repatriate its after-tax earnings and has no subpart F income?

A) $24,000

B) $84,000

C) $400,000

D) $60,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Verdi Inc.has before-tax income of $500,000.Verdi operates entirely in state Q,which has a 10% corporate income tax.Compute Verdi's combined federal and state tax burden as a percentage of its before-tax income.

A) 28.9%

B) 31%

C) 44%

D) 40.6%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about subpart F income is false?

A) Subpart F income is constructively repatriated to U.S.shareholders of a controlled foreign corporation (CFC) when earned.

B) Subpart F income has no commercial or economic connection to the CFC's home country.

C) Subpart F income includes income from the manufacture of goods in the CFC's home country.

D) Subpart F income includes income from the purchase of goods from a related party that are subsequently sold to another related party for use outside the CFC's home country.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a corporation with a 21% marginal federal income tax rate pays $20,000 state income tax,the after-tax cost of the state tax is $15,800.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lincoln Corporation,a U.S.corporation,owns 50% of the stock of a controlled foreign corporation (CFC) .At the beginning of the year,Lincoln's basis in its CFC stock was $100,000.The CFC's current-year income was $1 million,$600,000 of which was subpart F income.The CFC paid no foreign income tax and distributed no dividends.How much current taxable income must Lincoln report as a result of its ownership of the CFC?

A) $100,000

B) $600,000

C) $300,000

D) $0

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

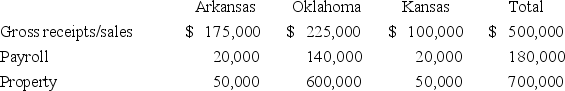

Tri-State's,Inc.operates in Arkansas,Oklahoma,and Kansas.Assume that each state has adopted the UDITPA formula.During the corporation's tax year ended December 31,the apportionment data indicated:  Tri-State's income for the current year is $250,000.Approximately how much income will be taxed by Oklahoma?

Tri-State's income for the current year is $250,000.Approximately how much income will be taxed by Oklahoma?

A) $250,000

B) $218,125

C) $44,375

D) $173,750

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Multi-State,Inc.does business in two states.Its apportionment percentage in state A is 63%.Its apportionment percentage in the other state can be no more than 37%.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following cases are the U.S.shareholders in a controlled foreign corporation (CFC) avoiding U.S.tax on the CFC's income?

A) The CFC operates in a jurisdiction with a tax rate lower than the U.S.rate,has no subpart F income,and 100% of its income is global-intangible low-taxed income.

B) The CFC operates in a jurisdiction with a tax rate lower than the U.S.rate,has no subpart F or global intangible low-taxed income,and pays no dividends.

C) The CFC operates in a jurisdiction with a tax rate lower than the U.S.rate,and 100% of the CFC's income is subpart F income.

D) The CFC operates in a jurisdiction with a tax rate lower than the U.S.rate; 50% of its income is subpart F income and 50% is global intangible low-taxed income.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The foreign tax credit is available only for foreign income,excise,value-added,sales,property and transfer taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fallon Inc.,a U.S.corporation,owns stock in several foreign corporations.This year,Fallon received $420,000 as a dividend from Mars Corporation,and $225,000 as a dividend from Jupiter Inc.Mars is a foreign corporation in which Fallon has owned 8 percent of the outstanding stock for ten years.Jupiter is a foreign corporation in which Fallon has owned 17 percent of the outstanding stock for two years.Compute Fallon's allowable dividends-received deduction for these foreign dividends.

A) $420,000

B) $225,000

C) $665,000

D) $0

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If Gamma Inc.is incorporated in Ohio and has its commercial domicile in Cleveland,the state of Ohio has jurisdiction to tax 100% of Gamma's business income.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 111

Related Exams