B) False

Correct Answer

verified

Correct Answer

verified

True/False

If Japan is a large country it cannot influence the terms of trade when it imposes a tariff on imports.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the absence of international trade, assume that the equilibrium price and quantity of motorcycles in Canada is $14,000 and 10 units respectively. Assuming that Canada is a small country that is unable to affect the world price of motorcycles, suppose its market is opened to international trade. As a result, the price of motorcycles falls to $12,000 and the total quantity demanded rises to 14 units; out of this total, 6 units are produced in Canada while 8 units are imported. Now assume that the Canadian government levies an import tariff of $1,000 on motorcycles. With the tariff, 8 units are produced in Canada and quantity demanded is 12 units. -Figure 4.4 represents the market for gasoline in a small nation.The free trade world price of gasoline is $3.50.Suppose this small nation imposes a tariff on gasoline of $.50 per gallon.The change in consumer surplus would be

A) $15.

B) $12.50.

C) $27.50.

D) $57.50.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country gains from international trade when its post-trade consumption point

A) lies outside its production possibilities frontier.

B) lies along its production possibilities frontier.

C) lies inside its production possibilities frontier.

D) is the same as the pre-trade consumption point.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Germany levies a tariff on oranges, but none are grown in Germany.This tariff has

A) only a protective effect.

B) only a revenue effect.

C) both a protective effect and revenue effect.

D) no effects on trade.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Although tariffs on imported steel may lead to job gains for domestic steel workers, they can lead to job losses for domestic auto workers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Japan levies a 40 percent tariff on pickup trucks and a 20 percent tariff on engines.The effective rate of protection on pickup trucks

A) is higher with the tariff on engines.

B) is lower with the tariff on engines.

C) is the same with or without the tariff on engines.

D) is equal to the tariff on engines.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

According to the tariff escalation effect, industrial countries apply low tariffs to imports of finished goods and high tariffs to imports of raw materials.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An optimum tariff benefits

A) the importing nation.

B) exporting nations.

C) the world economy.

D) smaller nations.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a tariff reduces the quantity of Japanese autos imported by the United States, over time it reduces the ability of Japan to import goods from the United States.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Concerning U.S.tariff policy, the offshore assembly provision (OAP) provides unfavorable treatment to products assembled abroad from U.S.made components.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

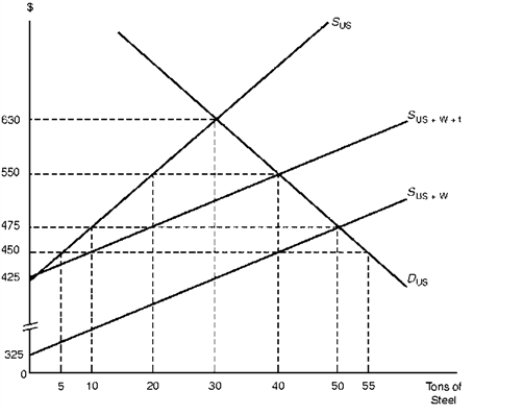

Assume the United States is a large consumer of steel that is able to influence the world price. Its demand and supply schedules are respectively denoted by DU.S. and SU.S. in Figure 4.2. The overall (United States plus world) supply schedule of steel is denoted by SU.S.+W.

Figure 4.2. Import Tariff Levied by a "Large" Country  ?

-Suppose that the production of $500,000 worth of steel in the United States requires $100,000 worth of iron ore.The U.S.nominal tariff rates are 15 percent for steel and 5 percent for iron ore.Given this information, the effective rate of protection for the U.S.steel industry is approximately

?

-Suppose that the production of $500,000 worth of steel in the United States requires $100,000 worth of iron ore.The U.S.nominal tariff rates are 15 percent for steel and 5 percent for iron ore.Given this information, the effective rate of protection for the U.S.steel industry is approximately

A) 6 percent.

B) 12.5 percent.

C) 18 percent.

D) 17.5 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A tariff on steel imports tends to improve the competitiveness of domestic automobile companies.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

During a recession, when consumers tend to purchase cheaper products, a specific tariff provides domestic producers a greater amount of protection against import-competing goods than other types of tariffs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The deadweight losses of a tariff consist of the sum of the protective effect plus the consumption effect.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Ecuador is considered a "small" country, a tariff will ______ increase its national welfare.

A) never

B) always

C) sometimes

D) only slightly

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Graphically, consumer surplus is the area above the demand curve and below the product's market price.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A specific tariff is expressed as a fixed percentage of the total value of an imported product.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

With a compound tariff, the "specific" portion neutralizes the cost disadvantage of domestic manufacturers that results from tariff protection granted to domestic suppliers of raw materials, and the "ad valorem" portion grants protection to the finished-goods industry.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a "small" country, a tariff raises the domestic price of an imported product by the full amount of the tariff.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 157

Related Exams