A) (ii) only

B) (iii) only

C) (i) and (ii) only

D) (i) , (ii) ,and (iii)

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

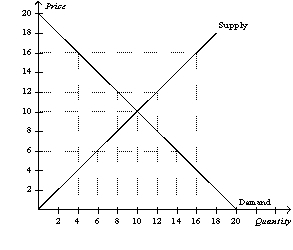

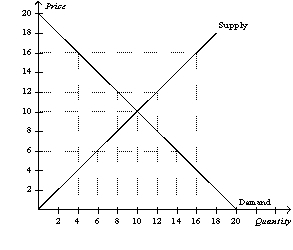

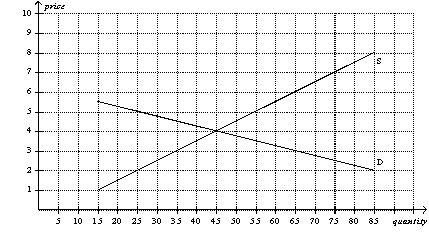

Figure 6-4  -Refer to Figure 6-4.A government-imposed price of $6 in this market could be an example of a

(i) Binding price ceiling.

(ii) Non-binding price ceiling.

(iii) Binding price floor.

(iv) Non-binding price floor.

-Refer to Figure 6-4.A government-imposed price of $6 in this market could be an example of a

(i) Binding price ceiling.

(ii) Non-binding price ceiling.

(iii) Binding price floor.

(iv) Non-binding price floor.

A) (i) only

B) (ii) only

C) (i) and (iv) only

D) (ii) and (iii) only

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $500 tax per car on sellers of cars,then the price received by sellers of cars would

A) decrease by less than $500.

B) decrease by exactly $500.

C) decrease by more than $500.

D) increase by an indeterminate amount.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

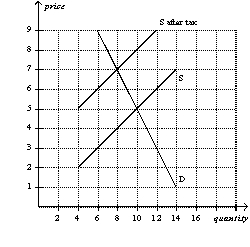

Suppose the government imposes a 20-cent tax on the sellers of iced tea.Which of the following is not correct? The tax would

A) shift the supply curve upward by 20 cents.

B) raise the equilibrium price by 20 cents.

C) reduce the equilibrium quantity.

D) discourage market activity.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product,then there will be a(n)

A) upward shift of the demand curve.

B) downward shift of the demand curve.

C) movement up and to the left along the demand curve.

D) movement down and to the right along the demand curve.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the sellers of a product,the

A) size of the market decreases.

B) effective price received by sellers decreases,and the price paid by buyers increases.

C) supply of the product decreases.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government has imposed a price ceiling on laptop computers.Which of the following events could transform the price ceiling from one that is not binding into one that is binding?

A) Improvements in production technology reduce the costs of producing laptop computers.

B) The number of firms selling laptop computers decreases.

C) Consumers' income decreases,and laptop computers are a normal good.

D) The number of consumers buying laptop computers decreases.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A surplus results when a

A) nonbinding price floor is imposed on a market.

B) nonbinding price floor is removed from a market.

C) binding price floor is imposed on a market.

D) binding price floor is removed from a market.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

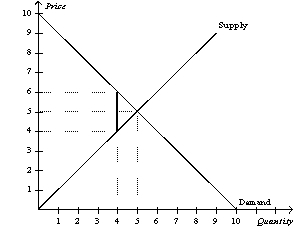

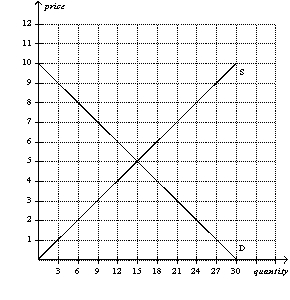

Figure 6-27  -Refer to Figure 6-27.If the government places a $2 tax in the market,the buyer pays $4.

-Refer to Figure 6-27.If the government places a $2 tax in the market,the buyer pays $4.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Unlike minimum wage laws,wage subsidies

A) discourage firms from hiring the working poor.

B) cause unemployment.

C) help only wealthy workers.

D) raise the living standards of the working poor without creating unemployment.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on buyers will shift the

A) demand curve upward by the amount of the tax.

B) demand curve downward by the amount of the tax.

C) supply curve upward by the amount of the tax.

D) supply curve downward by the amount of the tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-19  -If a tax is levied on the buyers of dog food,then

-If a tax is levied on the buyers of dog food,then

A) buyers will bear the entire burden of the tax.

B) sellers will bear the entire burden of the tax.

C) buyers and sellers will share the burden of the tax.

D) the government will bear the entire burden of the tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax imposed on the buyers of a good will lower the

A) price paid by buyers and lower the equilibrium quantity.

B) price paid by buyers and raise the equilibrium quantity.

C) effective price received by sellers and lower the equilibrium quantity.

D) effective price received by sellers and raise the equilibrium quantity.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-4  -Refer to Figure 6-4.A government-imposed price of $6 in this market is an example of a

-Refer to Figure 6-4.A government-imposed price of $6 in this market is an example of a

A) binding price ceiling that creates a shortage.

B) non-binding price ceiling that creates a shortage.

C) binding price floor that creates a surplus.

D) non-binding price floor that creates a surplus.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Economic policies often have effects that their architects did not intend or anticipate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is currently a tax of $50 per ticket on airline tickets.Buyers of airline tickets are required to pay the tax to the government.If the tax is reduced from $50 per ticket to $30 per ticket,then the

A) demand curve will shift upward by $20,and the price paid by buyers will decrease by less than $20.

B) demand curve will shift upward by $20,and the price paid by buyers will decrease by $20.

C) supply curve will shift downward by $20,and the effective price received by sellers will increase by less than $20.

D) supply curve will shift downward by $20,and the effective price received by sellers will increase by $20.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-8  -Refer to Figure 6-8.When a certain price control is imposed on this market,the resulting quantity of the good that is actually bought and sold is such that buyers are willing and able to pay a maximum of P1 dollars per unit for that quantity and sellers are willing and able to accept a minimum of P2 dollars per unit for that quantity.If P1 - P2 = $3,then the price control is

-Refer to Figure 6-8.When a certain price control is imposed on this market,the resulting quantity of the good that is actually bought and sold is such that buyers are willing and able to pay a maximum of P1 dollars per unit for that quantity and sellers are willing and able to accept a minimum of P2 dollars per unit for that quantity.If P1 - P2 = $3,then the price control is

A) a price ceiling of $2.00.

B) a price ceiling of $5.00.

C) a price floor of $5.00.

D) either a price ceiling of $2.00 or a price floor of $5.00.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following causes a surplus of a good?

A) a binding price floor

B) a binding price ceiling

C) a tax on the good

D) More than one of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The term tax incidence refers to how the burden of a tax is distributed among the various people who make up the economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-9  -Refer to Figure 6-9.A price ceiling set at

-Refer to Figure 6-9.A price ceiling set at

A) $4 will be binding and will result in a shortage of 3 units.

B) $4 will be binding and will result in a shortage of 6 units.

C) $7 will be binding and will result in a surplus of 6 units.

D) $7 will be binding and will result in a surplus of 12 units.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 561 - 580 of 593

Related Exams