A) cost of production report

B) equivalent units of production

C) manufacturing cells

D) yield

E) just-in-time processing

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a process costing system, indirect materials are charged to Work in Process.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

What are the equivalent units of production used to compute unit conversion cost on the cost of production report for Department W? Assume the company uses FIFO.

A) 16,100 units

B) 13,600 units

C) 15,000 units

D) 18,500 units

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Equivalent units are the sum of direct materials used and direct labor incurred.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The number of equivalent units of production for the period for conversion if the average cost method is used to cost inventories was

A) 15,650

B) 14,850

C) 18,000

D) 17,250

F) All of the above

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

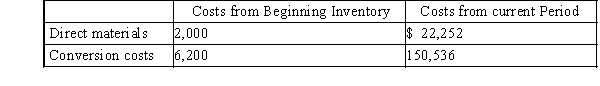

-At the beginning of the period, there were 500 units in process that were 60% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 4,500 units were started and completed. Ending inventory contained 340 units that were 30% complete as to conversion costs and 100% complete as to materials costs. Assume that the company uses the FIFO process cost method. Round cost per unit figures to two cents, i.e., $2.22, when calculating total costs. The total costs that will be transferred into Finished Goods for units started and completed were

-At the beginning of the period, there were 500 units in process that were 60% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 4,500 units were started and completed. Ending inventory contained 340 units that were 30% complete as to conversion costs and 100% complete as to materials costs. Assume that the company uses the FIFO process cost method. Round cost per unit figures to two cents, i.e., $2.22, when calculating total costs. The total costs that will be transferred into Finished Goods for units started and completed were

A) $161,775

B) $156,960

C) $162,855

D) $161,505

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Just-in-time processing is a business philosophy that focuses on reducing time and cost and eliminating poor quality. This is accomplished in manufacturing and nonmanufacturing processes by

A) moving a product from process to process as each function is completed

B) combining processing functions into work centers and cross-training workers to perform more than one function

C) having production supervisors attempt to enter enough materials into manufacturing to keep all manufacturing departments operating

D) having workers typically perform one function on a continuous basis

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

One of the differences in accounting for a process costing system compared to a job order system is that the amounts used to transfer goods from one department to the next comes from the cost of production report instead of job cost cards.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Assuming that all direct materials are placed in process at the beginning of production and that the first-in, first-out method of inventory costing is used, what is the material and conversion cost per unit to the nearest penny) , respectively.

A) $5.94 and $5.86

B) $5.94 and $6.38

C) $8.00 and $8.68

D) $9.84 and $9.58

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mocha Company manufactures a single product by a continuous process, involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000, $125,000, and $150,000, respectively. Work in process at the beginning of the period for Department 1 was $75,000, and work in process at the end of the period totaled $60,000. The records indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $50,000, $60,000, and $70,000, respectively. In addition, work in process at the beginning of the period for Department 2 totaled $75,000, and work in process at the end of the period totaled $60,000. The journal entry to record the flow of costs into Department 3 during the period is

A) Work in Process-Department 3 Work in Process-Department 2 585,000

585,000

B) Work in Process-Department 3 Work in Process-Department 2 570,000

570,000

C) Work in Process-Department 3 Work in Process-Department 2 555,000

555,000

D) Work in Process-Department 3 Work in Process-Department 2 165,000

165,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A process cost system be appropriate for a

A) natural gas refinery

B) jet airplane builder

C) catering business

D) custom cabinet builder

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a department that applies FIFO process costing starts the reporting period with 50,000 physical units that were 25% complete with respect to direct materials and 40% complete with respect to conversion, it must add 12,500 equivalent units of direct materials and 20,000 equivalent units to direct labor to complete them.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The three categories of manufacturing costs comprising the total cost of work in process are direct labor, direct materials, and

A) selling expenses

B) direct expenses

C) accounting salaries expense

D) factory overhead

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The conversion cost per equivalent unit to the nearest cent) for April is

A) $2.70

B) $2.53

C) $3.31

D) $5.60

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

In a process costing system, a separate work in process inventory account is maintained for each customer's job.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If 10,000 units that were 40% completed are in process at November 1, 80,000 units were completed during November, and 12,000 were 20% completed at November 30, the number of equivalent units of production for November was 75,600. Assume no loss of units in production and that inventories are costed by the first-in, first- out method.)

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Industries that typically use process cost systems include chemicals, oil, metals, food, paper, and pharmaceuticals.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Zang Co. manufacturers its products in a continuous process involving two departments, Machining and Assembly. Prepare journal entries to record the following transactions related to production during June: a) Materials purchased on account, $180,000 b) Materials requisitioned by: Machining, $73,000 direct and $9,000 indirect materials; Assembly, $4,900 indirect materials c) Direct labor used by Machining, $23,000; Assembly, $47,000 d) Depreciation expenses: Machining, $4,500; Assembly, $7,800 e) Factory overhead applied: Machining, $9,700; Assembly, $11,300 f) Machining Department transferred $98,300 to Assembly Department; Assembly Department transferred $83,400 to finished goods g) Sold goods on account, $100,000; cost of goods sold, $68,000

Correct Answer

verified

Correct Answer

verified

Essay

FastFlow Paints produces mixer base paint through a two-stage process, Mixing and Packaging. The following events depict the movement of value into and out of production. Journalize each event if appropriate; if not, provide a short narrative reason as to why you choose not to journalize the action. Nelson, the production manager, accepts an order to continue processing the current run of mixer base paint. a) Materials worth $27,000.00 are withdrawn from raw materials inventory. Of this amount, $25,500.00 will be issued to the Mixing Department and the balance will be issued to the Maintenance Department to be used on production line machines. b) Nelson calculates that labor for the period is $12,500.00. Of this amount, $1,750.00 is for maintenance and indirect labor. The remainder is directly associated with mixing. c) Nelson, who is paid a salary but earns about $35.00/hour, spends 1 hour inspecting the production line. d) The manufacturing overhead drivers for mixing are hours of mixer time at $575.00 per hour, and material movements from materials at $125.00 per movement. An inspection of the machine timers reveals that a total of 8 hours has been consumed in making this product. An inspection of "stocking orders" indicates that only one material movement was utilized to load the raw materials. Note: All values have been journalized to Factory Overhead, you need only apply them to the production run.)e) Within Fast-Flow, items are transferred between departments at a standard cost. This production run has created 4,015 gallons of mixer base paint. This paint is transferred to Packaging at a standard cost of $10.05 per gallon. Round calculation to nearest whole dollar.)f) Packaging draws $755.00 of materials for packaging of this production run. g) Packaging documents that 12 hours of direct labor at $10.25 per hour were consumed in the packaging of this production run. h) Packaging uses a cost driver of direct labor hours to allocate manufacturing overhead at the rate of $25.00 per hour. i) Packaging transfers 4,015 gallons of packaged goods to Finished Goods Inventory at a standard cost of $10.34 per gallon. Round calculation to nearest whole dollar.)

Correct Answer

verified

Correct Answer

verified

True/False

The FIFO method separates work done on beginning inventory in the previous period from work done on it in the current period.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 198

Related Exams