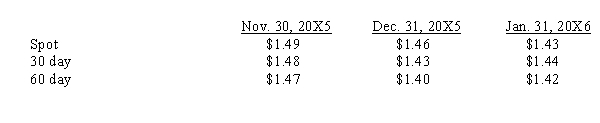

Larson, Inc. sold merchandise for 600,000 FC to a foreign vendor on November 30, 20X5. Payment in foreign currency is due January 31, 20X6. On the same day, Larson signed an agreement with a foreign exchange broker to sell 600,000 FC on January 31, 20X6. The discount rate is 8% and exchange rates to purchase 1 FC are as follows:  What is the net amount of the gains or losses recognized in the financial statements for the year ended December 31, 20x5?

What is the net amount of the gains or losses recognized in the financial statements for the year ended December 31, 20x5?

A) $5,840 gain

B) $6,000 loss

C) $18,000 loss

D) $12,000 gain

F) A) and D)

Correct Answer

verified

Correct Answer

verified

On September 15, 20X2, Wall Company, a U.S. firm, purchased a piece of equipment from a foreign firm for 500,000 FC. Payment for the equipment was to be made in FC on January 15, 20X3. The spot rates on selected dates were as follows:  Required:

a.Assuming that the US Corp. has a December 31 year end, prepare the necessary journal entries to account for the series of transactions involving the purchase.

b.Prepare all the necessary journal entries assuming that the US Corp. will be paying for the equipment in U.S. dollars.

Required:

a.Assuming that the US Corp. has a December 31 year end, prepare the necessary journal entries to account for the series of transactions involving the purchase.

b.Prepare all the necessary journal entries assuming that the US Corp. will be paying for the equipment in U.S. dollars.

Correct Answer

verified

Correct Answer

verified