A) FIFO and LIFO.

B) FIFO and average.

C) LIFO and average.

D) FIFO, LIFO and average.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

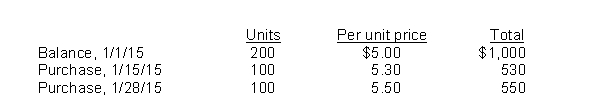

Effie Company uses a periodic inventory system. Details for the inventory account for the month of January, 2015 are as follows:  An end of the month (1/31/15) inventory showed that 160 units were on hand. How many units did the company sell during January, 2015?

An end of the month (1/31/15) inventory showed that 160 units were on hand. How many units did the company sell during January, 2015?

A) 60

B) 160

C) 200

D) 240

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Two companies report the same cost of goods available for sale but each employs a different inventory costing method. If the price of goods has increased during the period, then the company using

A) LIFO will have the highest ending inventory.

B) FIFO will have the highest cost of good sold.

C) FIFO will have the highest ending inventory.

D) LIFO will have the lowest cost of goods sold.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory items on an assembly line in various stages of production are classified as

A) Finished goods.

B) Work in process.

C) Raw materials.

D) Merchandise inventory.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a consignment arrangement, the

A) consignor has ownership until goods are sold to a customer.

B) consignor has ownership until goods are shipped to the consignee.

C) consignee has ownership when the goods are in the consignee's possession.

D) consigned goods are included in the inventory of the consignee.

F) C) and D)

Correct Answer

verified

A

Correct Answer

verified

True/False

Under the FIFO method, the costs of the earliest units purchased are the first charged to cost of goods sold.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Use of the LIFO inventory valuation method enables a company to report paper or phantom profits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sawyer Company uses the perpetual inventory system and the moving-average method to value inventories. On August 1, there were 10,000 units valued at $30,000 in the beginning inventory. On August 10, 20,000 units were purchased for $6 per unit. On August 15, 24,000 units were sold for $12 per unit. The amount charged to cost of goods sold on August 15 was

A) $30,000.

B) $108,000.

C) $120,000.

D) $144,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If a company uses the FIFO cost flow assumption, the cost of goods sold for the period will be the same under a perpetual or periodic inventory system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The specific identification method of inventory costing

A) always maximizes a company's net income.

B) always minimizes a company's net income.

C) has no effect on a company's net income.

D) may enable management to manipulate net income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Management may choose any inventory costing method it desires as long as the cost flow assumption chosen is consistent with the physical movement of goods in the company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the lower-of-cost-or-market basis in valuing inventory, market is defined as

A) current replacement cost.

B) selling price.

C) historical cost plus 10%.

D) selling price less markup.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Days in inventory is calculated by dividing

A) the inventory turnover by 365 days.

B) average inventory by 365 days.

C) 365 days by the inventory turnover.

D) 365 days by average inventory.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Beginning inventory plus the cost of goods purchased equals

A) cost of goods sold.

B) cost of goods available for sale.

C) net purchases.

D) total goods purchased.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventoriable costs include all of the following except the

A) freight costs incurred when buying inventory.

B) costs of the purchasing and warehousing departments.

C) cost of the beginning inventory.

D) cost of goods purchased.

F) B) and C)

Correct Answer

verified

B

Correct Answer

verified

True/False

The cost of goods available for sale consists of the beginning inventory plus the cost of goods purchased.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies adopt different cost flow methods for each of the following reasons except

A) balance sheet effects.

B) cost effects.

C) income statements effects.

D) tax effects.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Inventories are reported in the current assets section of the balance sheet immediately below receivables.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting principle that requires that the cost flow assumption be consistent with the physical movement of goods is

A) called the expense recognition principle.

B) called the consistency principle.

C) nonexistent; that is, there is no accounting requirement.

D) called the physical flow assumption.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An error that overstates the ending inventory will also cause net income for the period to be overstated.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 161

Related Exams