A) Specific identification

B) LIFO

C) FIFO

D) Average cost

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost of goods sold is computed from the following equation:

A) beginning inventory - cost of goods purchased + ending inventory.

B) sales - cost of goods purchased + beginning inventory - ending inventory.

C) sales + gross profit - ending inventory + beginning inventory.

D) beginning inventory + cost of goods purchased - ending inventory.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The lower-of-cost-or-market basis is an example of the accounting concept of conservatism.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

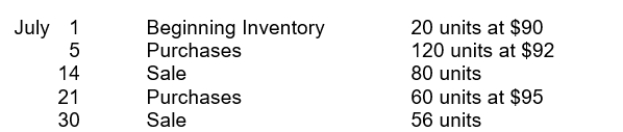

Pappy's Staff Junkets has the following inventory information.  Assuming that a perpetual inventory system is used, what is the ending inventory on a LIFO basis?

Assuming that a perpetual inventory system is used, what is the ending inventory on a LIFO basis?

A) $5,848

B) $5,860

C) $6,068

D) $6,346

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a company has no beginning inventory and the unit price of inventory is increasing during a period, the cost of goods available for sale during the period will be the same under the LIFO and FIFO inventory methods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

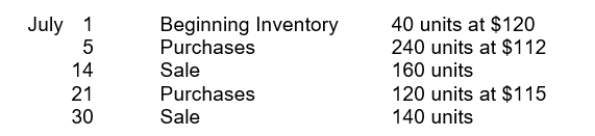

Moroni Industries has the following inventory information.  Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a FIFO basis?

Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a FIFO basis?

A) $11,500

B) $11,520

C) $33,960

D) $33,980

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Othello Company understated its inventory by $20,000 at December 31, 2014. It did not correct the error in 2014 or 2015. As a result, Othello's stockholder's equity was:

A) understated at December 31, 2014, and overstated at December 31, 2015.

B) understated at December 31, 2014, and properly stated at December 31, 2015.

C) overstated at December 31, 2014, and overstated at December 31, 2015.

D) understated at December 31, 2014, and understated at December 31, 2015.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The more inventory a company has in stock, the greater the company's profit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

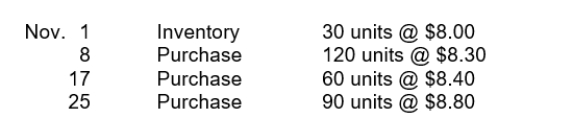

Netta Shutters has the following inventory information.  A physical count of merchandise inventory on November 30 reveals that there are 90 units on hand. Assume a periodic inventory system is used. Assuming that the specific identification method is used and that ending inventory consists of 20 units from each of the three purchases and 30 units from the November 1 inventory, cost of goods sold is

A physical count of merchandise inventory on November 30 reveals that there are 90 units on hand. Assume a periodic inventory system is used. Assuming that the specific identification method is used and that ending inventory consists of 20 units from each of the three purchases and 30 units from the November 1 inventory, cost of goods sold is

A) $1,740.

B) $1,772.

C) $1,782.

D) $1,794.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Freight terms of FOB shipping point mean that the

A) seller must debit freight out.

B) buyer must bear the freight costs.

C) goods are placed free on board at the buyer's place of business.

D) seller must bear the freight costs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The requirements for accounting for and reporting of inventories under IFRS, compared to GAAP, tend to be more

A) detailed.

B) rules-based.

C) principles-based.

D) full of disclosure requirements.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At May 1, 2015, Kibbee Company had beginning inventory consisting of 200 units with a unit cost of $7. During May, the company purchased inventory as follows:  The company sold 1,000 units during the month for $12 per unit. Kibbee uses the average cost method. The value of Kibbee's inventory at May 31, 2015 is

The company sold 1,000 units during the month for $12 per unit. Kibbee uses the average cost method. The value of Kibbee's inventory at May 31, 2015 is

A) $3,000.

B) $4,425.

C) $4,500.

D) $7,500.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchased inventory as follows:  The average unit cost for inventory is

The average unit cost for inventory is

A) $5.00.

B) $5.50.

C) $5.70.

D) $6.00.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the retail inventory method, the estimated cost of ending inventory is computed by multiplying the cost-to-retail ratio by

A) net sales.

B) goods available for sale at retail.

C) goods purchased at retail.

D) ending inventory at retail.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventories affect

A) only the balance sheet.

B) only the income statement.

C) both the balance sheet and the income statement.

D) neither the balance sheet nor the income statement.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

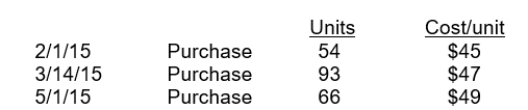

Romanoff Industries had the following inventory transactions occur during 2015:  The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

A) $2,322

B) $2,486

C) $3,318

D) $3,552

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The selection of an appropriate inventory cost flow assumption for an individual company is made by

A) the external auditors.

B) the SEC.

C) the internal auditors.

D) management.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When valuing ending inventory under a perpetual inventory system, the

A) valuation using the LIFO assumption is the same as the valuation using the LIFO assumption under the periodic inventory system.

B) moving average requires that a new average be computed after every sale.

C) valuation using the FIFO assumption is the same as under the periodic inventory system.

D) earliest units purchased during the period using the LIFO assumption are allocated to the cost of goods sold when units are sold.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The specific identification method of costing inventories is used when the

A) physical flow of units cannot be determined.

B) company sells large quantities of relatively low cost homogeneous items.

C) company sells large quantities of relatively low cost heterogeneous items.

D) company sells a limited quantity of high-unit cost items.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information was available for Pete Company at December 31, 2015: beginning inventory $90,000; ending inventory $70,000; cost of goods sold $984,000; and sales $1,350,000. Pete's inventory turnover in 2015 was

A) 10.9 times.

B) 12.3 times.

C) 14.1 times.

D) 16.9 times.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 161

Related Exams