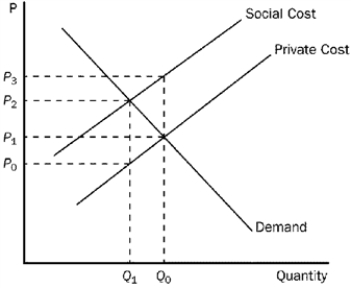

Figure 10-14  -Refer to Figure 10-14. Which of the following statements is correct?

-Refer to Figure 10-14. Which of the following statements is correct?

A) To induce firms to internalize the externality in this market, the government should impose a tax measured by P2 - P0.

B) To induce firms to internalize the externality in this market, the government should offer a subsidy measured by P2 - P0.

C) To induce firms to internalize the externality in this market, the government should impose a tax measured by P2 - P1.

D) There is no externality in this market.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Thurman is a writer who works from his home. Thurman lives next door to Phil, the drummer for a local band. Phil needs a lot of practice to earn $250, which is his share of the band's profit. Thurman gets distracted by Phil's drumming but he needs to get his writing done to earn $500 for his current article. Which of the following is an efficient solution?

A) Phil offers Thurman $499 to allow Phil to continue drumming. Thurman accepts and both are better off.

B) Phil offers Thurman $249 to allow Phil to continue drumming. Thurman accepts and both are better off.

C) Thurman offers Phil $251 to stop practicing his drumming. Phil agrees and both are better off.

D) Thurman offers Phil $501 to stop practicing his drumming. Phil agrees and both are better off.

F) All of the above

Correct Answer

verified

Correct Answer

verified