A) $490

B) $686

C) $630

D) $560

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A merchandising company's net income is determined by subtracting operating expenses from gross profit.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sales allowances and Sales discounts are both designed to encourage customers to pay their accounts promptly.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Sales Returns and Allowances account is not debited if a customer

A) returns defective merchandise.

B) receives a credit for merchandise of inferior quality.

C) utilizes a prompt payment incentive.

D) returns goods that are not in accordance with specifications.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Indiana Ink, Inc. has net sales of $400,000 and cost of goods sold of $300,000, Indiana Ink's gross profit rate is

A) 75%.

B) 33%

C) 25%.

D) 100%.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a seller records a return of goods, the account that is credited is

A) Sales Revenue.

B) Sales Returns and Allowances.

C) Inventory.

D) Accounts Receivable.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Under GAAP, companies can choose which inventory system?

Correct Answer

verified

Correct Answer

verified

Essay

Assume that Mitchell Company uses a periodic inventory system and has these account balances: Purchases $620,000; Purchase Returns and Allowances $25,000; Purchases Discounts $11,000; and Freight-In $19,000; beginning inventory of $45,000; ending inventory of $55,000; and net sales of $750,000. Determine the amounts to be reported for cost of goods sold and gross profit.

Correct Answer

verified

Correct Answer

verified

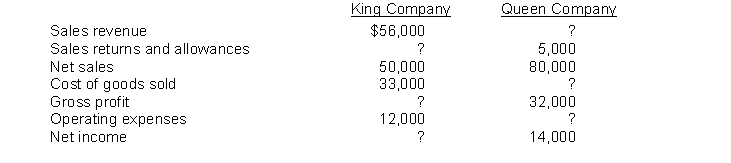

Essay

Financial information is presented here for two companies.  Instructions

(a) Compute the missing amounts.

(b) Calculate the profit margin and the gross profit rate for each company.

Instructions

(a) Compute the missing amounts.

(b) Calculate the profit margin and the gross profit rate for each company.

Correct Answer

verified

Correct Answer

verified

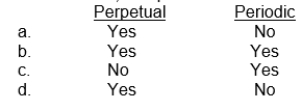

Multiple Choice

Which of the following is a true statement about inventory systems?

A) Periodic inventory systems require more detailed inventory records.

B) Perpetual inventory systems require more detailed inventory records.

C) A periodic system requires cost of goods sold be determined after each sale.

D) A perpetual system determines cost of goods sold only at the end of the accounting period.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A merchandiser that sells directly to consumers is a

A) retailer.

B) wholesaler.

C) broker.

D) service enterprise.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The terms 2/10, net/30 mean that a 2 percent discount is allowed on payments made within the 10 days discount period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Income from operations appears on both the single-step and multiple-step forms of an income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial information is presented below:  Gross profit would be

Gross profit would be

A) $114,000.

B) $ 36,000.

C) $ 45,000.

D) $ 24,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Sales revenues, cost of goods sold, and gross profit are amounts on a merchandising company's income statement not commonly found on the income statement of a service company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After gross profit is calculated, operating expenses are deducted to determine

A) gross margin.

B) net income.

C) gross profit on sales.

D) net margin.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a jewelry retailer, which is an example of Other Revenues and Gains?

A) Repair revenue

B) Unearned revenue

C) Gain on sale of display cases

D) Discount received for paying for merchandise inventory within the discount period

F) C) and D)

Correct Answer

verified

Correct Answer

verified

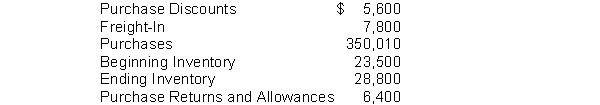

Multiple Choice

Sampson Company's accounting records show the following at the year ending on December 31, 2014.  Using the periodic system, the cost of goods sold is

Using the periodic system, the cost of goods sold is

A) $351,110.

B) $348,910.

C) $340,510.

D) $359,510.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

On October 1, the Kile Bicycle Store had an inventory of 20 ten speed bicycles at a cost of $150 each. During the month of October the following transactions occurred. Assume Kile uses a perpetual inventory system. Oct. 4 Purchased 180 bicycles at a cost of $145 each from the Nixon Bicycle Company, terms 2/10, n/30. 5 Paid freight of $1,000 on the October 4 purchase. 6 Sold 10 bicycles from the October 1 inventory to Team America for $250 each, terms 2/10, n/30. 7 Received credit from the Nixon Bicycle Company for the return of 8 defective bicycles. 13 Issued a credit memo to Team America for the return of a defective bicycle. 14 Paid Nixon Bicycle Company in full, less discount. Instructions Prepare the journal entries to record the transactions assuming the company uses a perpetual inventory system.

Correct Answer

verified

Correct Answer

verified

Essay

June 4 Black Company purchased $9,000 worth of merchandise, terms n/30 from Hayes Company. The cost of the merchandise was $6,300. 12 Black returned $500 worth of goods to Hayes for full credit. The goods had a cost of $350 to Hayes. 12 Black paid the account in full. Instructions Prepare the journal entries to record these transactions in (a) Black's records and (b) Hayes' records. Assume use of the perpetual inventory system for both companies.

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 261

Related Exams