A) 11.00 percent

B) 11.09 percent

C) 11.18 percent

D) 11.27 percent

E) 11.31 percent

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want to buy a new sports coupe for $41,750, and the finance office at the dealership has quoted you an 8.6 percent APR loan compounded monthly for 48 months to buy the car.What is the effective interest rate on this loan?

A) 8.28 percent

B) 8.41 percent

C) 8.72 percent

D) 8.87 percent

E) 8.95 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A preferred stock pays an annual dividend of $3.20.What is one share of this stock worth today if the rate of return is 11.75 percent?

A) $23.48

B) $25.00

C) $27.23

D) $33.80

E) $35.55

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want to buy a new sports car for $55,000.The contract is in the form of a 60-month annuity due at a 6 percent APR, compounded monthly.What will your monthly payment be?

A) $1,047.90

B) $1,053.87

C) $1,058.01

D) $1,063.30

E) $1,072.11

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

First Century Bank wants to earn an effective annual return on its consumer loans of 10 percent per year.The bank uses daily compounding on its loans.By law, what interest rate is the bank required to report to potential borrowers?

A) 9.23 percent

B) 9.38 percent

C) 9.53 percent

D) 9.72 percent

E) 10.00 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are preparing to make monthly payments of $72, beginning at the end of this month, into an account that pays 6 percent interest compounded monthly.How many payments will you have made when your account balance reaches $9,312?

A) 97

B) 100

C) 119

D) 124

E) 131

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Atlas Insurance wants to sell you an annuity which will pay you $1,600 per quarter for 25 years.You want to earn a minimum rate of return of 6.5 percent.What is the most you are willing to pay as a lump sum today to buy this annuity?

A) $72,008.24

B) $74,208.16

C) $78,818.41

D) $83,008.80

E) $88,927.59

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your car dealer is willing to lease you a new car for $245 a month for 48 months.Payments are due on the first day of each month starting with the day you sign the lease contract.If your cost of money is 6.5 percent, what is the current value of the lease?

A) $10,331.03

B) $10,386.99

C) $12,197.74

D) $12,203.14

E) $13,008.31

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following terms is used to identify a British perpetuity?

A) ordinary annuity

B) amortized cash flow

C) annuity due

D) discounted loan

E) consol

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering changing jobs.Your goal is to work for three years and then return to school full-time in pursuit of an advanced degree.A potential employer just offered you an annual salary of $41,000, $43,000, and $46,000 a year for the next three years, respectively.All salary payments are made as lump sum payments at the end of each year.The offer also includes a starting bonus of $3,000 payable immediately.What is this offer worth to you today at a discount rate of 6.75 percent?

A) $111,406

B) $114,545

C) $116,956

D) $120,212

E) $133,697

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blackwell, Inc.has a $75,000 liability it must pay three years from today.The company is opening a savings account so that the entire amount will be available when this debt needs to be paid.The plan is to make an initial deposit today and then deposit an additional $15,000 each year for the next three years, starting one year from today.The account pays a 4.5 percent rate of return.How much does the firm need to deposit today?

A) $18,299.95

B) $20,072.91

C) $21,400.33

D) $24,487.78

E) $31,076.56

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gene's Art Gallery is notoriously known as a slow-payer.The firm currently needs to borrow $27,500 and only one company will even deal with them.The terms of the loan call for daily payments of $100.The first payment is due today.The interest rate is 24 percent, compounded daily.What is the time period of this loan? Assume a 365 day year.

A) 264.36 days

B) 280.81 days

C) 303.22 days

D) 316.46 days

E) 341.09 days

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following terms is defined as a loan wherein the regular payments, including both interest and principal amounts, are insufficient to retire the entire loan amount, which then must be repaid in one lump sum?

A) amortized loan

B) continuing loan

C) balloon loan

D) remainder loan

E) interest-only loan

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering an annuity which costs $160,000 today.The annuity pays $17,500 a year at an annual interest rate of 7.50 percent.What is the length of the annuity time period?

A) 13 years

B) 14 years

C) 15 years

D) 16 years

E) 17 years

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You just acquired a mortgage in the amount of $249,500 at 6.75 percent interest, compounded monthly.Equal payments are to be made at the end of each month for thirty years.How much of the first loan payment is interest? (Assume each month is equal to 1/12 of a year.)

A) $925.20

B) $1,206.16

C) $1,403.44

D) $1,511.21

E) $1,548.60

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You need a 30-year, fixed-rate mortgage to buy a new home for $240,000.Your mortgage bank will lend you the money at a 7.5 percent APR for this 360-month loan, with interest compounded monthly.However, you can only afford monthly payments of $850, so you offer to pay off any remaining loan balance at the end of the loan in the form of a single balloon payment.What will be the amount of the balloon payment if you are to keep your monthly payments at $850?

A) $1,112,464

B) $1,113,316

C) $1,114,480

D) $1,115,840

E) $1,116,315

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Miley expects to receive the following payments: Year 1 = $50,000; Year 2 = $28,000; Year 3 = $12,000.All of this money will be saved for her retirement.If she can earn an average of 10.5 percent on her investments, how much will she have in her account 25 years after making her first deposit?

A) $772,373

B) $789,457

C) $806,311

D) $947,509

E) $1,033,545

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

This morning, you borrowed $150,000 to buy a house.The mortgage rate is 7.35 percent.The loan is to be repaid in equal monthly payments over 20 years.The first payment is due one month from today.How much of the second payment applies to the principal balance? (Assume that each month is equal to 1/12 of a year.)

A) $268.84

B) $277.61

C) $917.06

D) $925.83

E) $1,194.67

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

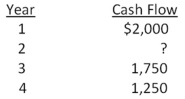

The present value of the following cash flow stream is $5,933.86 when discounted at 11 percent annually.What is the value of the missing cash flow?

A) $1,500

B) $1,750

C) $2,000

D) $2,250

E) $2,500

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have your choice of two investment accounts.Investment A is a 5-year annuity that features end-of-month $2,500 payments and has an interest rate of 11.5 percent compounded monthly.Investment B is a 10.5 percent continuously compounded lump sum investment, also good for five years.How much would you need to invest in B today for it to be worth as much as investment A five years from now?

A) $108,206.67

B) $119,176.06

C) $124,318.08

D) $129,407.17

E) $131,008.15

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 128

Related Exams