B) False

Correct Answer

verified

Correct Answer

verified

True/False

IFRS allows companies to cost inventory using either the LIFO or the FIFO cost flow assumption.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net realizable value refers to

A) the net amount the company expects to realize from the sale.

B) the selling price.

C) the cost to replace the item.

D) the gross profit realized from the sale.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the inventory reported on the statement of financial position is understated, then net income reported on the income statement is understated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The lower-of-cost-or-net realizable value basis of valuing inventories is an example of

A) comparability.

B) the cost principle.

C) prudence.

D) consistency.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Merchandise inventory is

A) reported under the classification of Property, Plant, and Equipment on the statement of financial position.

B) often reported as a miscellaneous expense on the income statement.

C) reported as a current asset on the statement of financial position.

D) generally valued at the price for which the goods can be sold.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting principle that requires that the cost flow assumption be consistent with the physical movement of goods is

A) called the matching principle.

B) called the consistency principle.

C) nonexistent; that is, there is no accounting requirement.

D) called the physical flow assumption.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paulson, Inc.has 5 computers which have been part of the inventory for over two years.Each computer cost ₤600 and originally retailed for ₤825.At the statement date, each computer has a net realizable value of ₤350.What value should Paulson, Inc., have for the computers at the end of the year?

A) ₤1,250.

B) ₤1,750.

C) ₤3,000.

D) $4,125.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the unit price of inventory is increasing during a period, a company using the average-cost inventory method will show less gross profit for the period, than if it had used the FIFO inventory method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of goods available for sale is allocated to the cost of goods sold and the

A) beginning inventory.

B) ending inventory.

C) cost of goods purchased.

D) gross profit.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ted's Used Cars uses the specific identification method of costing inventory.During March, Ted purchased three cars for $8,000, $10,000, and $13,000, respectively.During March, two cars are sold for $12,000 each.Ted determines that at March 31, the $13,000 car is still on hand.What is Ted's gross profit for March?

A) $7,000.

B) $6,000.

C) $1,000.

D) $11,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Goods that have been purchased FOB destination but are in transit, should be excluded from a physical count of goods.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The lower-of-cost-or-net realizable value basis is an example of the accounting concept of prudence.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a result of a thorough physical inventory, Hastings Company determined that it had inventory worth $540,000 at December 31, 2011.This count did not take into consideration the following facts: Carlin Consignment store currently has goods worth $104,000 on its sales floor that belong to Hastings but are being sold on consignment by Carlin.The selling price of these goods is $150,000.Hastings purchased $40,000 of goods that were shipped on December 27 FOB destination, that will be received by Hastings on January 3.Determine the correct amount of inventory that Hastings should report.

A) $580,000.

B) $684,000.

C) $644,000.

D) $690,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a company has no beginning inventory and the unit price of inventory is increasing during a period, the cost of goods available for sale during the period will be the same under the average-cost and FIFO inventory methods.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

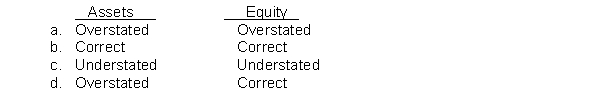

A company uses the periodic inventory method and the beginning inventory is overstated by $4,000 because the ending inventory in the previous period was overstated by $4,000.The amounts reflected in the current end of the period statement of financial position are

Correct Answer

verified

Correct Answer

verified

Essay

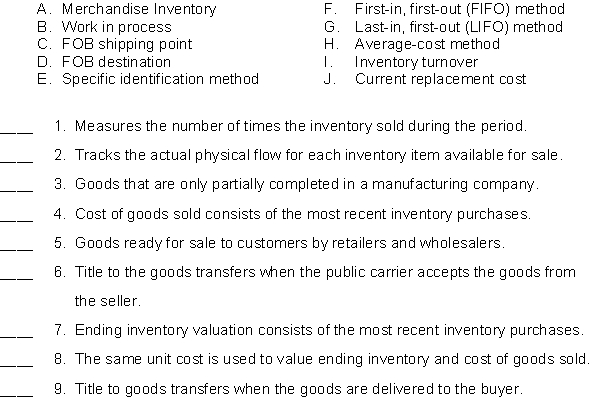

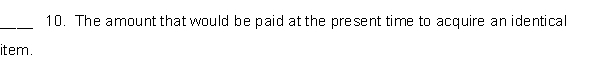

Match the items below by entering the appropriate code letter in the space provided.

Correct Answer

verified

Correct Answer

verified

True/False

The specific identification method of costing inventories tracks the actual physical flow of the goods available for sale.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The consistent application of an inventory costing method is essential for

A) prudence.

B) accuracy.

C) comparability.

D) efficiency.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Companies have the choice of physically counting inventory on hand at the end of the year or using the gross profit method to estimate the ending inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 156

Related Exams