A) a liability of the Federal Reserve Banks and commercial banks.

B) an asset of the Federal Reserve Banks and commercial banks.

C) a liability of the Federal Reserve Banks and an asset for commercial banks.

D) an asset of the Federal Reserve Banks and a liability for commercial banks.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recent years (after the financial crisis of 2008) , the Fed has added a new element to its open-market operations, which is

A) buying and selling foreign-government securities.

B) taking government bonds as collateral on loans to banks and other financial institutions.

C) the trading of state- and local-government bonds.

D) accepting corporate stocks and bonds as bank reserves.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The discount rate is the interest rate at which commercial banks lend to their best corporate customers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Board of Governors of the Federal Reserve System increases the legal reserve ratio, this change will

A) increase the excess reserves of member banks and thus increase the money supply.

B) increase the excess reserves of member banks and thus decrease the money supply.

C) decrease the excess reserves of member banks and thus decrease the money supply.

D) decrease the excess reserves of member banks and thus increase the money supply.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate that banks charge one another for the loan of excess reserves is the

A) prime interest rate.

B) federal funds rate.

C) discount rate.

D) interest on reserves.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

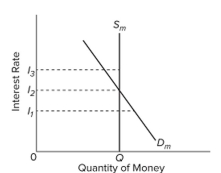

Refer to the diagram of the market for money. The downward slope of the money demand curve is best explained in terms of the

Refer to the diagram of the market for money. The downward slope of the money demand curve is best explained in terms of the

A) transactions demand for money.

B) direct or positive relationship between bond prices and interest rates.

C) asset demand for money.

D) wealth or real-balances effect.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A) $75.

B) $125.

C) $200.

D) $325.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The table shows items and ?gures taken from a consolidated balance sheet of the 12 Federal Reserve Banks. All ?gures are in billions of dollars. In this balance sheet, the liabilities and net worth would be items 7 and

A) 1, 3, and 5.

B) 2, 4, and 5.

C) 1, 2, and 3.

D) 4, 5, and 6.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed buys government securities from commercial banks in the open market,

A) the Fed gives the securities to the commercial banks and increases the banks' reserves.

B) the Fed gives the securities to the commercial banks and decreases the banks' reserves.

C) commercial banks give the securities to the Fed, and the Fed increases the banks' reserves.

D) commercial banks give the securities to the Fed, and the Fed decreases the banks' reserves.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An expansionary monetary policy may be less effective than a restrictive monetary policy because

A) the Federal Reserve Banks are always willing to make loans to commercial banks that are short of reserves.

B) fiscal policy always works at cross purposes with an expansionary monetary policy.

C) changes in exchange rates complicate an expansionary monetary policy more than they do a restrictive monetary policy.

D) commercial banks may not be able to find good loan customers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the demand for money increases and the Fed wants interest rates to remain unchanged, which of the following would be appropriate policy?

A) recall Federal Reserve Notes from circulation

B) raise the legal reserve requirement

C) buy bonds in the open market

D) raise the discount rate

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the table. Suppose that the transactions demand for money is $300 billion and the money supply is $700 billion. A decrease in the money supply to $600 billion would cause the interest rate to

A) rise to 7 percent.

B) rise to 6 percent.

C) fall to 4 percent.

D) fall to 5 percent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Before the financial crisis of 2008, expansionary monetary policy would have entailed the Fed targeting a lower federal funds rate and using open-market purchases to increase bank reserves to cause the federal funds rate to hit its target.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Holding money as an asset presents a risk of capital loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following Fed actions increases the excess reserves of commercial banks?

A) selling bonds to the public

B) selling bonds to commercial banks

C) increasing the discount rate

D) lowering the reserve ratio

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed, at the end of 2015, announced its intent to start "normalizing" monetary policy and returning short-term interest rates to their normal range. Its normalization plan had two major tools,

A) taxation and spending.

B) discount rate and reserve requirements.

C) quantitative easing and open-market operations.

D) raising the interest on excess reserves held at Fed banks and quantitative tightening.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that a single commercial bank has no excess reserves and that the reserve ratio is 20 percent. If this bank sells a bond for $1,000 to a Federal Reserve Bank, it can expand its loans by a maximum of

A) $1,000.

B) $2,000.

C) $800.

D) $5,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A television report states: "The Federal Reserve will lower the discount rate for the fourth time this year." This report indicates that the Federal Reserve is most likely trying to

A) reduce inflation.

B) save the banking industry.

C) stimulate the economy.

D) improve the savings rate.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed's inability to stimulate the economy by reducing interest rates is known as the

A) zero lower bound problem.

B) zero upper bound problem.

C) negative interest rate problem.

D) quantitative easing problem.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes what occurs when monetary authorities sell government securities?

A) There is a decrease in the size of commercial banks' excess reserves, the money supply increases, and interest rates fall, thereby causing a decrease in investment spending and real GDP.

B) There is a decrease in the size of commercial banks' excess reserves, the money supply decreases, and interest rates rise, thereby causing a decrease in investment spending and real GDP.

C) There is a decrease in the size of commercial banks' excess reserves, the money supply decreases, and interest rates rise, thereby causing an increase in investment spending and real GDP.

D) There is an increase in the size of commercial bank reserves, the money supply increases, and interest rates fall, thereby causing an increase in investment spending and real GDP.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 405

Related Exams