A) Consolidated interest expense on the bonds is $44,000

B) Eliminating entry (O) decreases interest expense by $4,000

C) If market interest rates are 4% at the date of consolidation, no entry (O) is needed

D) Eliminating entry (R) increases bonds payable by $20,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is true concerning impairment testing of identifiable intangible assets, following U.S. GAAP?

A) For limited life intangibles, the impairment loss is the difference between the sum of undiscounted expected cash flows and book value.

B) If the sum of undiscounted expected cash flows is less than book value, the impairment loss calculation for limited life intangibles is the same as for indefinite life intangibles.

C) A qualitative test may be used for limited life intangibles but not indefinite life intangibles.

D) A qualitative test may be used for both limited life and indefinite life intangibles.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

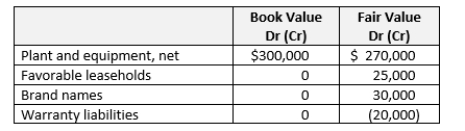

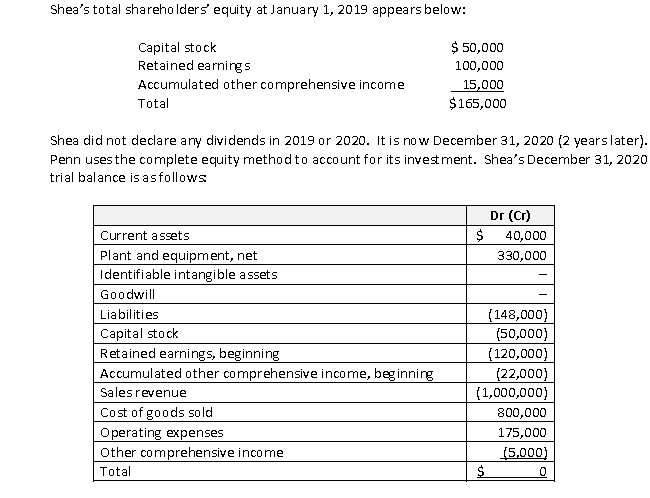

On January 1, 2019, Penn Corporation acquired the voting stock of Shea Company at an acquisition cost of $450,000. Some of Shea's assets and liabilities at the date of acquisition had fair values that were different from reported values, as follows:

At the date of acquisition, the plant and equipment had a 10-year remaining life, and the favorable leases had a 5-year remaining life, straight-line. The brand names are indefinite life assets. They were impaired by $3,000 in 2019, and were not impaired in 2020. Goodwill from this acquisition is not impaired as of the beginning of 2020, but goodwill impairment for 2020 is $1,000. Warranty payments connected with the revaluation liability were $500 in 2019 and $1,500 in 2020.

At the date of acquisition, the plant and equipment had a 10-year remaining life, and the favorable leases had a 5-year remaining life, straight-line. The brand names are indefinite life assets. They were impaired by $3,000 in 2019, and were not impaired in 2020. Goodwill from this acquisition is not impaired as of the beginning of 2020, but goodwill impairment for 2020 is $1,000. Warranty payments connected with the revaluation liability were $500 in 2019 and $1,500 in 2020.

Shea does not pay dividends.

Required

a. Calculate the goodwill recognized with this acquisition.

b. Calculate equity in net income for 2019 and 2020, reported on Penn's books.

c. Calculate the December 31, 2020 balance for Investment in Shea, reported on Penn's books.

d. Present consolidation eliminating entries (C), (E), (R) and (O) to consolidate the December 31, 2020 trial balances of Penn and Shea.

Shea does not pay dividends.

Required

a. Calculate the goodwill recognized with this acquisition.

b. Calculate equity in net income for 2019 and 2020, reported on Penn's books.

c. Calculate the December 31, 2020 balance for Investment in Shea, reported on Penn's books.

d. Present consolidation eliminating entries (C), (E), (R) and (O) to consolidate the December 31, 2020 trial balances of Penn and Shea.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer bellow Questions: On January 1, 2018, Pearson Company acquired all of Sundisk Company's voting stock for $20,000 in cash. Sundisk's total shareholders' equity at January 1, 2018 was $5,000. Some of Sundisk's assets and liabilities at the date of acquisition had fair values that were different from reported values, as follows: It is now December 31, 2020 (3 years later) . Impairment of recognized identifiable intangibles totals $400 for 2018 and 2019, and there is no impairment in 2020. There is no goodwill impairment as of the beginning of 2020, but goodwill impairment for 2020 is $1,200. Pearson uses the complete equity method to account for its investment. December 31, 2020 trial balances for Pearson and Sundisk follow: The following questions relate to consolidation eliminating entries for 2020. -Eliminating entry (E) credits Investment in Sundisk in the amount of:

A) $ 2,000

B) $25,900

C) $12,000

D) $13,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company reports $11.2 million in goodwill and decides to quantitatively test it for impairment at the end of 2020. The following information is collected: What is the amount of goodwill impairment loss for 2020, following U.S. GAAP?

A) $ 6,200,000

B) $11,200,000

C) $ 6,500,000

D) $ 6,000,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a possible reason why IFRS companies may report more goodwill impairment losses than U.S. GAAP companies?

A) IFRS users interpret the qualitative "more likely than not" question more conservatively than U.S. GAAP companies, and therefore do the quantitative tests more frequently.

B) The recoverable value of goodwill may be lower than its fair value.

C) Cash generating units may be smaller than reporting units.

D) The qualitative evaluation allows U.S. companies to avoid quantitative goodwill impairment testing.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate at which an acquired company issued its long-term bonds payable is higher than the current market rate. The bonds have a four-year remaining life at the date of acquisition. Which statement is true concerning the write-off of revaluation of these bonds in the fourth year after acquisition (eliminating entry O) ?

A) Interest expense will increase

B) Bonds payable will increase

C) Interest expense will decrease

D) No eliminating entry (O) is needed

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An acquisition requires revaluation of a subsidiary's date-of-acquisition inventory from a book value of $5 million to fair value of $3 million. The subsidiary uses FIFO and sells the inventory in the first year following acquisition. Which statement is true concerning the consolidation eliminating entries for this revaluation?

A) Each year following acquisition, entry (R) reduces inventory and entry (O) increases cost of goods sold by $2 million.

B) After the first year, entry (R) reduces inventory by $2 million, but entry (O) is not required.

C) No entry (R) is required after the first year, but eliminating entry (O) reduces cost of goods sold by $2 million in the first year.

D) No entries are required in any year.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A wholly-owned subsidiary's revalued net assets at the date of acquisition consist of indefinite life identifiable intangible assets valued at $500,000 at the date of acquisition. Impairment of these intangibles as of the beginning of the current year is $50,000, and impairment testing for the current year reveals $200,000 in additional impairment on these intangibles. Consolidation eliminating entry (O) at the end of the current year reduces identifiable intangible assets by:

A) $250,000.

B) $500,000.

C) $200,000.

D) $50,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is true regarding the U.S. GAAP impairment test for limited life intangibles?

A) Even if the fair value of the intangible is less than its book value, it is possible that no impairment loss will be reported.

B) No impairment testing is necessary if it is more likely than not that the intangibles are not impaired.

C) Impairment loss always equals the difference between book and fair value of the intangibles, if book value exceeds fair value.

D) The impairment loss is calculated as the difference between fair value and original cost.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the date of acquisition, a subsidiary's inventory (LIFO, still held by the subsidiary) is overvalued by $600, its plant assets (10-year life, straight-line) are overvalued by $4,000, and it has previously unreported intangibles valued at $1,000 (2-year life, straight-line) . Goodwill from the acquisition is not impaired. In the third year following acquisition, the subsidiary reports net income of $2,500. Using the complete equity method, in the third year the parent reports equity in the net income of the subsidiary of:

A) $3,500

B) $2,100

C) $2,400

D) $2,900

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer bellow Questions: Park Corporation acquired the voting stock of Sequoia Company on January 1, 2020 for $25 million in cash and stock. At the date of acquisition, Sequoia's book value totaled $3 million, consisting of $1.6 million in capital stock, $1.8 million in retained earnings, and $400,000 in accumulated other comprehensive losses. Sequoia's reported net assets at the date of acquisition were carried at amounts approximating fair value, except its inventory was overvalued by $500,000 (sold in 2020) , its plant assets (10-year life, straight-line) were overvalued by $3,500,000, and its long-term debt (premium amortized over 10 years, straight-line) is undervalued by $100,000. Sequoia also had previously unreported identifiable intangibles (5-year life, straight-line) valued at $5,000,000. It is now December 31, 2020. Sequoia reports net income of $1,200,000 and other comprehensive income of $50,000 for 2020 and declares and pays dividends of $200,000. None of the revaluations are impaired in 2020. Park uses the complete equity method to account for its investment. -The balance for acquired identifiable intangibles on the December 31, 2020 consolidated balance sheet is:

A) $4,000,000

B) $5,000,000

C) $4,500,000

D) $1,000,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses IFRS and chooses to report certain generic intangible assets at fair value. On January 1, 2019, it acquires software for €100,000, with an estimated life of 4 years, straight-line. On December 31, 2019, the intangible has a fair value of €110,000. How is this change in value reported on the 2019 financial statements?

A) Other comprehensive gain, €10,000

B) Other comprehensive gain, €35,000

C) Gain on the income statement, €35,000

D) Not reported

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A subsidiary still holds all net assets revalued at the date of acquisition. Which working paper eliminating entry below is most likely to be the same whether the consolidation takes place at the date of acquisition or in subsequent years?

A) Write-off eliminating entry (O) adjustment to identifiable intangibles

B) Equity eliminating entry (E) adjustment to retained earnings

C) Equity eliminating entry (E) adjustment to capital stock

D) Revaluation eliminating entry (R) adjustment to plant assets

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer bellow Questions: A subsidiary is acquired on January 1, 2019 for $10,000. The subsidiary's book value at the date of acquisition was $2,000. Following is revaluation information for the subsidiary's identifiable net assets at the date of acquisition: Goodwill recognized in the acquisition was unimpaired in 2019 but became fully impaired during 2020. The subsidiary did not declare any dividends during this period and reported no other comprehensive income. The subsidiary reported net income as follows: The parent uses the complete equity method to report its investment on its own books. -Equity in net income for 2019, reported on the parent's books, is:

A) $1,500

B) $1,050

C) $ 150

D) $ 850

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 115 of 115

Related Exams