A) downward by the amount of the tax.

B) upward by the amount of the tax.

C) downward by less than the amount of the tax.

D) upward by more than the amount of the tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most correct statement about price controls?

A) Price controls always help those they are designed to help.

B) Price controls never help those they are designed to help.

C) Price controls often hurt those they are designed to help.

D) Price controls always hurt those they are designed to help.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Advocates of the minimum wage

A) deny that the minimum wage produces any adverse effects.

B) emphasize the benefits to teenagers of increases in the minimum wage.

C) emphasize the low annual incomes of those who work for the minimum wage.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers shifts the supply curve upward by exactly the amount of the tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

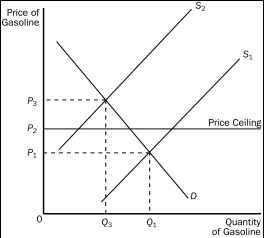

Figure 6-6

-Refer to Figure 6-6.When the price ceiling applies in this market and the supply curve for gasoline shifts from S₁ to S₂,the resulting quantity of gasoline that is bought and sold is

-Refer to Figure 6-6.When the price ceiling applies in this market and the supply curve for gasoline shifts from S₁ to S₂,the resulting quantity of gasoline that is bought and sold is

A) less than Q₃.

B) Q₃

C) between Q₁ and Q₃.

D) at least Q₁.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under rent control,bribery is a mechanism to

A) bring the total price of an apartment (including the bribe) closer to the equilibrium price.

B) allocate housing to the poorest individuals in the market.

C) force the total price of an apartment (including the bribe) to be less than the market price.

D) allocate housing to the most deserving tenants.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

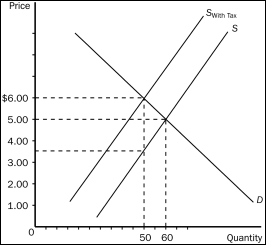

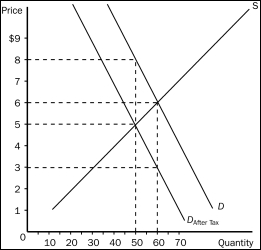

Figure 6-10

-Refer to Figure 6-10.The price paid by buyers after the tax is imposed is

-Refer to Figure 6-10.The price paid by buyers after the tax is imposed is

A) $1.00.

B) $3.50.

C) $5.00.

D) $6.00.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price ceilings and price floors that are binding

A) are desirable because they make markets more efficient and more equitable.

B) cause surpluses and shortages to persist since price cannot adjust to the market equilibrium price.

C) can have the effect of restoring a market to equilibrium.

D) are imposed because they can make the poor in the economy better off without causing adverse effects.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price ceiling

A) is a legal maximum on the price at which a good can be sold.

B) is often imposed in markets in which "cutthroat competition" would prevail without a price ceiling.

C) is often imposed when sellers of a good are successful in their attempts to convince the government that the market outcome is unfair without a price ceiling.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price controls

A) always produce an equitable outcome.

B) always produce an efficient outcome.

C) can generate inequities of their own.

D) produce revenue for the government.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

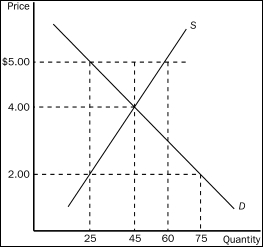

Figure 6-5

-Refer to Figure 6-5.When a certain price control is imposed in this market,the resulting quantity of the good that is actually bought and sold is such that buyers are willing and able to pay a maximum of P₁ dollars per unit for that quantity and sellers are willing and able to accept a minimum of P₂ dollars per unit for that quantity.If P₁ - P₂ = $3.00,then the price control in question is

-Refer to Figure 6-5.When a certain price control is imposed in this market,the resulting quantity of the good that is actually bought and sold is such that buyers are willing and able to pay a maximum of P₁ dollars per unit for that quantity and sellers are willing and able to accept a minimum of P₂ dollars per unit for that quantity.If P₁ - P₂ = $3.00,then the price control in question is

A) a price ceiling of $2.00.

B) a price ceiling of $5.00.

C) a price floor of $5.00.

D) either a price ceiling of $2.00 or a price floor of $5.00.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

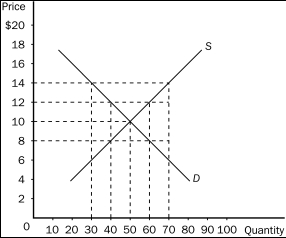

Figure 6-2

-Refer to Figure 6-2.A binding price ceiling would be the result if the price ceiling were set at

-Refer to Figure 6-2.A binding price ceiling would be the result if the price ceiling were set at

A) $14.

B) $12.

C) $10.

D) $8.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the buyers of coffee will

A) increase the effective price of coffee paid by buyers, increase the price of coffee received by sellers, and increase the equilibrium quantity of coffee.

B) decrease the effective price of coffee paid by buyers, increase the price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

C) increase the effective price of coffee paid by buyers, decrease the price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

D) increase the effective price of coffee paid by buyers, decrease the price of coffee received by sellers, and increase the equilibrium quantity of coffee.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-8

-Refer to Figure 6-8.Suppose the same S and D curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the sellers of the good,rather than the buyers,are required to pay the tax to the government.Now,relative to the case depicted in the figure,

-Refer to Figure 6-8.Suppose the same S and D curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the sellers of the good,rather than the buyers,are required to pay the tax to the government.Now,relative to the case depicted in the figure,

A) the burden on buyers will be larger and the burden on sellers will be smaller.

B) the burden on buyers will be smaller and the burden on sellers will be larger.

C) the burden on buyers will be the same and the burden on sellers will be the same.

D) The relative burdens in the two cases cannot be determined without further information.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A legal minimum price at which a good can be sold is

A) exemplified by rent-control laws.

B) usually intended to enhance efficiency in a market.

C) called a price ceiling.

D) called a price floor.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is imposed on a market with elastic demand and inelastic supply,

A) buyers will bear most of the burden of the tax.

B) sellers will bear most of the burden of the tax.

C) the burden of the tax will be shared equally between buyers and sellers.

D) it is impossible to determine how the burden of the tax will be shared.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

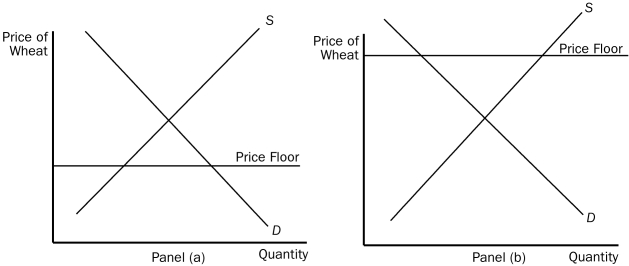

Figure 6-3

-Refer to Figure 6-3.In panel (b) ,with the price floor in effect,there will be

-Refer to Figure 6-3.In panel (b) ,with the price floor in effect,there will be

A) a shortage of wheat.

B) equilibrium in the market.

C) a surplus of wheat.

D) an excess demand for wheat.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A key lesson from the payroll tax is that the

A) tax amounts to a tax solely on workers.

B) tax amounts to a tax solely on firms that hire workers.

C) eliminates any wedge that might exist between the wage that firms pay and the wage that workers receive.

D) true burden of a tax cannot be legislated.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the demand for picture frames is elastic and the supply of picture frames is inelastic.A tax of $1 per frame levied on buyers of picture frames will increase the equilibrium price paid by buyers of picture frames by

A) $1.

B) more than $0.50 but less than $1.00.

C) a positive amount but less than $0.50.

D) It is impossible to say without more information.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a correct statement about the labor market?

A) Price controls are absent from the labor market, just as they are absent from many markets in the economy.

B) "The labor market" really consists of a multitude of labor markets for different types of workers.

C) Workers determine the demand for labor, and firms determine the supply of labor.

D) The forces of supply and demand, while present in the labor market, have nothing to balance in that market.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 252

Related Exams