A) They are equal.

B) The equilibrium quantity is greater than the socially optimal quantity.

C) The equilibrium quantity is less than the socially optimal quantity.

D) There is not enough information to answer the question.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two firms,A and B,each currently dump 50 tons of chemicals into the local river.The government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution dumped into the river.The government gives each firm 20 pollution permits,which it can either use or sell to the other firm.It costs Firm A $100 for each ton of pollution that it eliminates before it reaches the river,and it costs Firm B $50 for each ton of pollution that it eliminates before it reaches the river.It is likely that

A) Firm A will buy all of Firm B's pollution permits.Each one will cost between $50 and $100.

B) Firm B will buy all of Firm A's pollution permits.Each one will cost between $50 and $100.

C) Both firms will use their own pollution permits.

D) Firm A will buy some of Firm B's pollution permits.Each one will cost less than $50.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government wanted to ensure that the market reaches the socially optimal equilibrium in the presence of a technology spillover,it should

A) impose a corrective tax on any firm producing a technology spillover.

B) offer tax credits to consumers who are adversely affected by the new technology.

C) subsidize producers by an amount equal to the value of the technology spillover.

D) provide research grants to those firms not currently engaging in research to increase competition in the industry.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A corrective tax places a price on the right to pollute.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Figure 10-8.This graph shows the market for pollution when permits are issued to firms and traded in the marketplace.The equilibrium number of permits is

A) 50

B) 100

C) 1,000

D) 2,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nancy loves to landscape her yard,but her neighbor Lee places a low value on his landscaping.When Lee's grass is neglected and gets long,Nancy will mow it for Lee.This is an example of

A) a situation in which the Coase theorem fails to explain the lawn mowing arrangement.

B) an improper allocation of resources.

C) a private solution to a negative externality problem.

D) an exploitation of a common resource.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

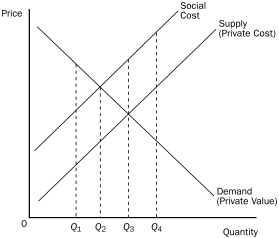

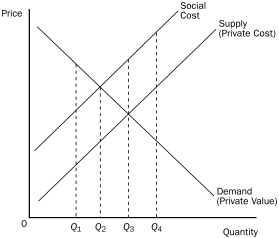

Figure 10-4

-Refer to Figure 10-4.If this market currently produces Q₂,total economic well-being would be maximized if

-Refer to Figure 10-4.If this market currently produces Q₂,total economic well-being would be maximized if

A) production decreased to Q₁.

B) production increased to Q₃.

C) this product were no longer produced.

D) output stayed at Q₂.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the case of a technology spillover,internalizing a positive externality will cause the supply curve of an industry to

A) shift down.

B) shift up.

C) become more elastic.

D) remain unchanged.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that at present there are no laws to restrict pollution produced by the widget industry.Assume that the supply and demand curves are linear and that the market price of a widget is $20.If the government imposes a tax equal in value to the cost of the pollution,then firms would continue to produce widgets if

A) the cost imposed by the pollution is less than $20 per widget produced.

B) the private cost of producing a widget equals the cost of the pollution generated per widget.

C) $20 minus the private cost of producing a widget is greater than the cost of the pollution generated per widget.

D) $20 minus the private cost of producing a widget is less than the cost of the pollution generated per widget.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about a well-maintained yard best conveys the general nature of the externality?

A) A well-maintained yard conveys a positive externality because it increases the home's market value.

B) A well-maintained yard conveys a negative externality because it increases the property tax liability of the owner.

C) A well-maintained yard conveys a positive externality because it increases the value of adjacent properties in the neighborhood.

D) A well-maintained yard cannot provide any type of externality.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All remedies for externalities share the goal of

A) moving the allocation of resources toward the market equilibrium.

B) moving the allocation of resources toward the socially optimal equilibrium.

C) increasing the allocation of resources.

D) decreasing the allocation of resources.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most taxes distort incentives and move the allocation of resources away from the social optimum.Why do corrective taxes avoid the disadvantages of most other taxes?

A) Corrective taxes apply only to goods that are bad for people's health, such as cigarettes and alcohol.

B) Because corrective taxes correct for market externalities, they take into consideration the well-being of bystanders.

C) Corrective taxes provide incentives for the conservation of natural resources.

D) Corrective taxes do not affect deadweight loss.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 10-4

-Refer to Figure 10-4.This market

-Refer to Figure 10-4.This market

A) has no need for government intervention.

B) would benefit from a tax on the product.

C) would benefit from a subsidy for the product.

D) would maximize total well-being at Q₃.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a negative externality exists in a market,the cost to producers

A) is greater than the cost to society.

B) will be the same as the cost to society.

C) will be less than the cost to society.

D) will differ from the cost to society, regardless of whether an externality is present.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Most economists prefer regulation to taxation because regulation corrects market inefficiencies at a lower cost than taxation does.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Coase theorem suggests that private markets may not be able to solve the problem of externalities

A) if the government does not become involved in the process.

B) when the number of interested parties is large and bargaining costs are high.

C) if the firm in the market is a monopoly.

D) if some people benefit from the externality.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When negative externalities are present in a market

A) private costs will be greater than social costs.

B) social costs will be greater than private costs.

C) only government regulation will solve the problem.

D) the market will not be able to reach any equilibrium.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The proposition that if private parties can bargain without cost over the allocation of resources,they can solve the problem of externalities on their own,is called

A) the transaction cost theorem.

B) a corrective tax.

C) the externality theorem.

D) the Coase theorem.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Externalities can be corrected by each of the following except

A) self-interest.

B) moral codes and social sanctions.

C) charity.

D) normal market adjustments.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the production of computer chips yields greater technology spillovers than the production of potato chips,the government should

A) encourage the production of computer chips with subsidies.

B) discourage the production of potato chips with taxes.

C) encourage the production of potato chips with subsidies.

D) discourage the production of computer chips with taxes.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 288

Related Exams