Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the maturity value of an investment which paid 13.9% was $400,000 after 7 months, how much of that amount was interest?

A) $30,001

B) $55,600

C) $32,433

D) $67,888

E) $27,999

G) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

What was the principal amount of a loan at 10½ % if total amount owed after 23 days was $785.16?

Correct Answer

verified

Correct Answer

verified

Short Answer

The interest paid at the end of the term of a $9125 loan at 0.8% per month was $511.00. Calculate the term of the loan.

Correct Answer

verified

Correct Answer

verified

Short Answer

$12,800 was invested in a 237-days term deposit earning 3¾ %. What was its maturity value?

Correct Answer

verified

Correct Answer

verified

Short Answer

The interest rate on a $3000 loan advanced on March 1 was 10.2%. What must the first payment on April 13 be in order that two subsequent payments of $1100 on May 27 and $1100 on July 13 settle the loan?

Correct Answer

verified

Correct Answer

verified

Short Answer

What will be the maturity value after seven months of $2950 earning interest at the rate of 4½ %?

Correct Answer

verified

Correct Answer

verified

Short Answer

Payments of $850 and $1140 were scheduled to be paid today and nine months from now, respectively. What total payment today would place the payee in the same financial position as the scheduled payments? Money can earn 8¼ %.

Correct Answer

verified

Correct Answer

verified

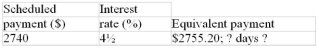

Short Answer

How many days separate equivalent payments of $2755.20 and $2740.00 if money can earn 4½ %?

Correct Answer

verified

Correct Answer

verified

Short Answer

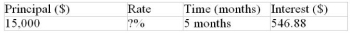

Calculate the missing value:

Correct Answer

verified

Correct Answer

verified

Short Answer

Sergon has $5000 to invest for six months. The rates offered on three-month and six-month term deposits at his bank are 5.5% and 5.8%, respectively. He is trying to choose between the six-month term deposit and two consecutive three-month term deposits. What would the simple interest rate on three-month term deposits have to be, three months from now, for Sergon to end up in the same financial position with either alternative? Assume that he would place both the principal and interest from the first three-month term deposit in the second three-month term deposit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculate the amount of interest that would be earned on an account of $344,000 if it earned 4.95% for 37 days.

A) $17,028

B) $11,124

C) $991

D) $1,726

E) $2,110

G) C) and E)

Correct Answer

verified

Correct Answer

verified

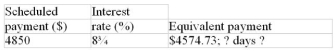

Short Answer

Calculate the missing value:

Correct Answer

verified

Correct Answer

verified

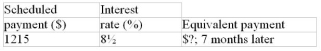

Short Answer

Calculate the missing value:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robert placed $7,000 in a 10-month term deposit paying 6.25%. How much will the term deposit be worth when it matures?

A) $3,645.83

B) $7,991.81

C) $7,364.58

D) $6,653.46

E) $7,769.89

G) A) and C)

Correct Answer

verified

Correct Answer

verified

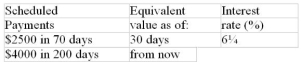

Short Answer

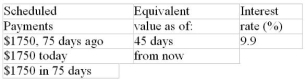

Calculate the equivalent value of the scheduled payments if money can earn the rate of return specified in the last column. Assume that any payments due before today have been missed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How much money would have to be deposited on March 11 into an account earning a simple interest rate of 9.5% if the goal is to have the deposit grow to $12,000 by November 1?

A) $10,860.00

B) $11,175.45

C) $14,098.36

D) $11,308.33

E) $11,497.44

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Calculate the missing value:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How much must be placed in a two-month term deposit earning 4.8% in order to earn $275 interest?

A) $12,500.00

B) $5729.17

C) $23,333.33

D) $34,375.00

E) $53,333.33

G) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Calculate the equivalent value of the scheduled payments if money can earn the rate of return specified in the last column. Assume that any payments due before today have been missed.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 159

Related Exams