A) increases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) decreases a tax on the good sold in that market.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct? In a 2006 survey of Ph.D. economists,

A) 47 percent favored eliminating the minimum wage.

B) 14 percent would maintain the minimum wage at its current level.

C) 38 percent would increase the minimum wage.

D) 10 percent would decrease the minimum wage.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

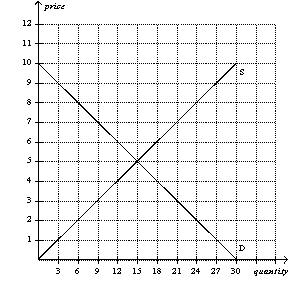

Figure 6-9  -Refer to Figure 6-9. At which price would a price ceiling be nonbinding?

-Refer to Figure 6-9. At which price would a price ceiling be nonbinding?

A) $2

B) $3

C) $4

D) $6

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Workers determine the supply of labor, and firms determine the demand for labor.

B) Workers determine the demand for labor, and firms determine the supply of labor.

C) The labor market is a single market for all different types of workers.

D) The price of the product produced by labor adjusts to balance the supply of labor and the demand for labor.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The minimum wage has its greatest impact on the market for teenage labor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the 1970s, long lines at gas stations in the United States were primarily a result of the fact that

A) OPEC raised the price of crude oil in world markets.

B) U.S. gasoline producers raised the price of gasoline.

C) the U.S. government maintained a price ceiling on gasoline.

D) Americans typically commuted long distances.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The true burden of a payroll tax has nothing to do with the percentage of the tax that employers are required to pay.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

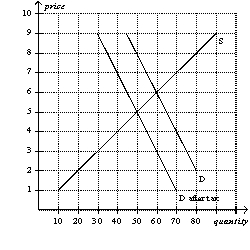

Figure 6-21  -Refer to Figure 6-21. The equilibrium price in the market before the tax is imposed is

-Refer to Figure 6-21. The equilibrium price in the market before the tax is imposed is

A) $1.

B) $2.

C) $5.

D) $6.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When government imposes a price ceiling or a price floor on a market,

A) price no longer serves as a rationing device.

B) efficiency in the market is enhanced.

C) shortages and surpluses are eliminated.

D) both buyers and sellers become better off.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal government uses the revenue from the FICA (Federal Insurance Contribution Act) tax to pay for

A) unemployment compensation.

B) the salaries of members of Congress.

C) Social Security and Medicare.

D) housing subsidies for low-income people.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

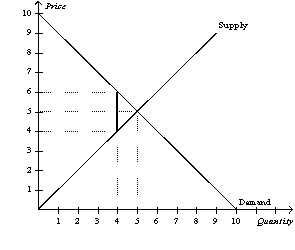

Figure 6-27  -Refer to Figure 6-27. If the government places a $2 tax in the market, the seller bears $2 of the tax burden.

-Refer to Figure 6-27. If the government places a $2 tax in the market, the seller bears $2 of the tax burden.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price paid by buyers in a market will decrease if the government

A) imposes a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) decreases a binding price floor in that market.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in a particular market, the demand curve is highly elastic, and the supply curve is highly inelastic. If a tax is imposed in this market, then the

A) buyers will bear a greater burden of the tax than the sellers.

B) sellers will bear a greater burden of the tax than the buyers.

C) buyers and sellers are likely to share the burden of the tax equally.

D) buyers and sellers will not share the burden equally, but it is impossible to determine who will bear the greater burden of the tax without more information.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a rationing mechanism, discrimination according to seller bias is

A) efficient and fair.

B) efficient, but potentially unfair.

C) inefficient, but fair.

D) inefficient and potentially unfair.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers usually causes buyers to pay more for the good and sellers to receive less for the good than they did before the tax was levied.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price ceiling is not binding, then

A) there will be a surplus in the market.

B) there will be a shortage in the market.

C) the market will be less efficient than it would be without the price ceiling.

D) there will be no effect on the market price or quantity sold.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a rationing mechanism used by landlords in cities with rent control?

A) waiting lists

B) race

C) price

D) bribes

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A legal maximum on the price at which a good can be sold is called a price

A) floor.

B) subsidy.

C) support.

D) ceiling.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the sellers of cell phones, the size of the cell phone market

A) and the price paid by buyers both increase.

B) increases, but the price paid by buyers decreases.

C) decreases, but the price paid by buyers increases.

D) and the price paid by buyers both decrease.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a price ceiling of $2 per gallon is imposed on gasoline, and the market equilibrium price is $1.50, then the price ceiling is a binding constraint on the market.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 556

Related Exams