A) A firm in Kenya wants to buy wheat from a Canadian firm.

B) A Japanese bank desires to purchase Canadian government securities.

C) A Canadian citizen wants to buy a bond issued by a Mexican corporation.

D) A Canadian citizen exchanges dollars for Euros.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is a surplus of loanable funds, which of the following best describes the consequences?

A) The quantity demanded is greater than the quantity supplied, and the interest rate will rise.

B) The quantity demanded is greater than the quantity supplied, and the interest rate will fall

C) The quantity demanded is less than the quantity supplied, and the interest rate will rise.

D) The quantity demanded is less than the quantity supplied, and the interest rate will fall.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes the effects of an increase in real interest rates in Canada?

A) It discourages both Canadian and foreign residents from buying Canadian assets.

B) It encourages both Canadian and foreign residents to buy Canadian assets.

C) It encourages Canadian residents to buy Canadian assets, but discourages foreign residents from buying Canadian assets.

D) It encourages foreign residents to buy Canadian assets, but discourages Canadian residents from buying Canadian assets.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in the supply of dollars in the market for foreign-currency exchange in the open-economy macroeconomic model?

A) A retail outlet in Afghanistan wants to buy watches from a Canadian manufacturer.

B) A Canadian bank loans dollars to Blair, a Canadian resident, who wants to purchase a new car made in Canada.

C) A Canadian-based mutual fund wants to purchase stock issued by a Polish company.

D) A Canadian resident imports a car made in Japan.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the world real interest rate exceeds the interest rate that would occur if the Canadian economy were closed, then the Canadian net capital outflow will be which of the following?

A) positive

B) negative

C) decreasing

D) increasing

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Canada imposes an import quota on automobiles. In the open-economy macroeconomic model, this quota would shift which of the following curves?

A) supply of loanable funds left

B) demand for loanable funds left

C) demand for Canadian dollars right

D) supply of Canadian dollars left

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following lists contains only things that increase when the budget deficit of the Canadian government increases?

A) Canadian supply of loanable funds, Canadian domestic investment

B) Canadian imports, the real exchange rate of the dollar

C) The real exchange rate of the dollar, Canadian domestic investment

D) the real exchange rate of the dollar, Canadian net exports

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An import quota imposed by Egypt would reduce Egyptian imports, but have no impact on Egyptian exports.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Because depreciation of the real exchange rate of the dollar increases Canadian net exports, the demand curve for dollars in the foreign-currency exchange market is downward sloping.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the theory of purchasing-power parity, what is the shape of the demand curve for foreign-currency exchange?

A) downward sloping

B) upward sloping

C) horizontal

D) vertical

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, where does the supply of loanable funds come from?

A) national saving

B) private saving

C) domestic investment

D) the sum of domestic investment and net capital outflow

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In the open-economy macroeconomic model, net capital outflow links the markets for loanable funds and foreign-currency exchange.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the world real interest rate is less than the real interest rate that would occur in Canada if there was no trade, then how does Canadian net capital outflow change?

A) It decreases.

B) It increases.

C) It does not change.

D) There is not sufficient information to determine the change in capital outflow.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, which of the following is the key determinant of net capital outflow?

A) the nominal exchange rate

B) the nominal interest rate

C) the real exchange rate

D) the real interest rate

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following does the open-economy macroeconomic model examine?

A) the determination of output growth rate and the real interest rate

B) the determination of unemployment and the exchange rate

C) the determination of output growth rate and the inflation rate

D) the determination of the trade balance and the exchange rate

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Mexico suffered from capital flight in 1994, which of the following best describes the effects of this event on Canadian economy?

A) Canadian demand for loanable funds and Canadian net capital outflow rose.

B) Canadian demand for loanable funds and Canadian net capital outflow fell.

C) Canadian demand for loanable funds fell, and Canadian net capital outflow rose.

D) Canadian demand for loanable funds rose, and Canadian net capital outflow fell.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Mexico suffered from capital flight in 1994, what happened to Mexico's real interest rate and the peso?

A) The real interest rate fell and the peso appreciated.

B) The real interest rate fell and the peso depreciated.

C) The real interest rate rose and the peso appreciated.

D) The real interest rate rose and the peso depreciated.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Although trade policies do not affect a country's overall trade balance, they do affect specific firms and industries.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are the effects of an increase in the supply of loanable funds?

A) Net capital outflow and the real exchange rate both increase.

B) Net capital outflow and the real exchange rate both decrease.

C) Net capital outflow increases, and the real exchange rate decreases.

D) Net capital outflow decreases, and the real exchange rate increases.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

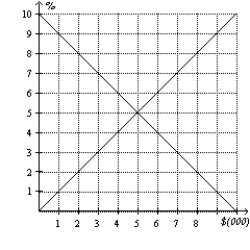

Figure 32-1  -Refer to Figure 32-1. If the world interest rate equals 6 percent, what is the net capital outflow?

-Refer to Figure 32-1. If the world interest rate equals 6 percent, what is the net capital outflow?

A) positive

B) negative

C) either positive or negative

D) Net capital outflow is not determined by the world interest rate.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 184

Related Exams