A) sellers are required to send one dollar to the government and buyers are required to send two dollars to the government.

B) sellers are required to send two dollars to the government and buyers are required to send one dollar to the government.

C) sellers are required to send three dollars to the government and buyers are required to send nothing to the government.

D) sellers are required to send nothing to the government and buyers are required to send two dollars to the government.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A price floor set below the equilibrium price causes quantity supplied to exceed quantity demanded.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following was not a result of the luxury tax imposed by Congress in 1990?

A) The larger part of the tax burden fell on sellers.

B) A larger part of the tax burden fell on the middle class than on the rich.

C) Even the wealthy demanded fewer luxury goods.

D) The tax was never repealed or even modified.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

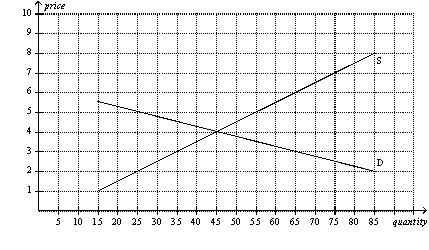

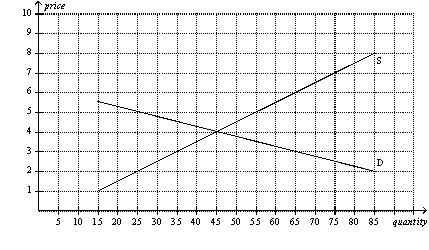

Figure 6-5  -Refer to Figure 6-5.The price of the good would continue to serve as the rationing mechanism if

-Refer to Figure 6-5.The price of the good would continue to serve as the rationing mechanism if

A) a price ceiling of $4 is imposed.

B) a price ceiling of $5 is imposed.

C) a price floor of $3 is imposed.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding minimum wage

A) alters both the quantity demanded and quantity supplied of labor.

B) affects only the quantity of labor demanded;it does not affect the quantity of labor supplied.

C) has no effect on the quantity of labor demanded or the quantity of labor supplied.

D) causes only temporary unemployment,since the market will adjust and eliminate any temporary surplus of workers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

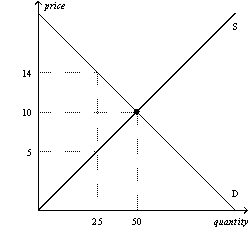

Figure 6-15  -Refer to Figure 6-15.Suppose a tax of $5 per unit is imposed on this market.How much will buyers pay per unit after the tax is imposed?

-Refer to Figure 6-15.Suppose a tax of $5 per unit is imposed on this market.How much will buyers pay per unit after the tax is imposed?

A) $5

B) between $5 and $10

C) between $10 and $14

D) $14

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States,before OPEC increased the price of crude oil in 1973,there was

A) no price ceiling on gasoline.

B) a nonbinding price ceiling on gasoline.

C) a binding price ceiling on gasoline.

D) a nonbinding price floor on gasoline.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

One common example of a price ceiling is rent control.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have responsibility for economic policy in the country of Freedonia.Recently,the neighboring country of Sylvania has cut off all exports of oranges to Freedonia.Harpo,who is one of your advisors,suggests that you should impose a binding price ceiling in order to avoid a shortage of oranges.Chico,another one of your advisors,argues that without a binding price floor,a shortage will certainly develop.Zeppo,a third advisor,says that the best way to avoid a shortage of oranges is to take no action at all.Which of your three advisors is most likely to have studied economics?

A) Harpo

B) Chico

C) Zeppo

D) Apparently,all three advisors have studied economics,but their views on positive economics are different.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Binding price ceilings benefit consumers because they allow consumers to buy all the goods they demand at a lower price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When policymakers set prices by legal decree,they

A) are usually following the advice of mainstream economists.

B) improve the organization of economic activity.

C) obscure the signals that normally guide the allocation of society's resources.

D) are demonstrating a willingness to sacrifice fairness for the sake of a gain in efficiency.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in a particular market,the demand curve is highly elastic and the supply curve is highly inelastic.If a tax is imposed in this market,then

A) the buyers will bear a greater burden of the tax than the sellers.

B) the sellers will bear a greater burden of the tax than the buyers.

C) the buyers and sellers are likely to share the burden of the tax equally.

D) the buyers and sellers will not share the burden equally,but it is impossible to determine who will bear the greater burden of the tax without more information.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

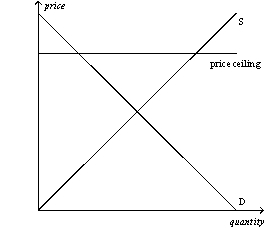

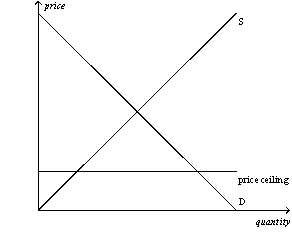

Figure 6-1

Panel (a) Panel (b)

-Refer to Figure 6-1.The situation in panel (a) may be described as one in which

-Refer to Figure 6-1.The situation in panel (a) may be described as one in which

A) the price ceiling is not binding.

B) the price ceiling really functions as a price floor.

C) a surplus of the good will be observed.

D) Both (b) and (c) are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

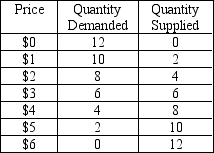

Table 6-1

-Refer to Table 6-1.Suppose the government imposes a price floor of $1 on this market.What will be the size of the surplus in this market?

-Refer to Table 6-1.Suppose the government imposes a price floor of $1 on this market.What will be the size of the surplus in this market?

A) 0 units

B) 2 units

C) 8 units

D) 10 units

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-5  -Refer to Figure 6-5.If the government imposes a price floor of $5 on this market,then the result is a

-Refer to Figure 6-5.If the government imposes a price floor of $5 on this market,then the result is a

A) surplus of 0 units of the good.

B) surplus of 20 units of the good.

C) surplus of 30 units of the good.

D) surplus of 55 units of the good.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Price ceilings are typically imposed to benefit buyers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers shifts the supply curve to the left.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Buyers and sellers always share the burden of a tax equally.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Although lawmakers legislated a fifty-fifty division of the payment of the FICA tax,

A) the actual tax incidence is unaffected by the legislated tax incidence.

B) the employer now is required by law to pay more than 50 percent of the tax.

C) the employee now is required by law to pay more than 50 percent of the tax.

D) employers are no longer required by law to pay any portion of the tax.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

All buyers benefit from a binding price ceiling.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 459

Related Exams