A) decrease.

B) either remain constant or decrease.

C) remain constant.

D) increase.

E) either remain constant or increase.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A group of stocks and bonds held by an investor is called which one of the following?

A) weights

B) grouping

C) basket

D) portfolio

E) bundle

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the future return on a security is known with absolute certainty,then the risk premium on that security should be equal to:

A) zero.

B) the risk-free rate.

C) the market rate.

D) the market rate minus the risk-free rate.

E) the risk-free rate plus one-half the market rate.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the extra compensation paid to an investor who invests in a risky asset rather than in a risk-free asset called?

A) efficient return

B) correlated value

C) risk premium

D) expected return

E) realized return

G) A) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Stock A has a standard deviation of 15 percent per year and stock B has a standard deviation of 8 percent per year.The correlation between stock A and stock B is .40.You have a portfolio of these two stocks wherein stock B has a portfolio weight of 40 percent.What is your portfolio variance?

A) 0.01143

B) 0.01214

C) 0.01329

D) 0.01437

E) 0.01470

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diversification is investing in a variety of assets with which one of the following as the primary goal?

A) increasing returns

B) minimizing taxes

C) reducing some risks

D) eliminating all risks

E) increasing the variance

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

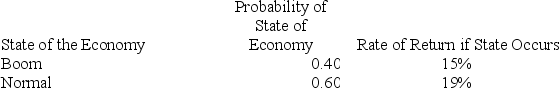

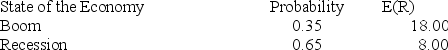

What is the variance of the expected returns on this stock?

A) 1.21

B) 1.42

C) 1.56

D) 3.84

E) 4.03

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are graphing the investment opportunity set for a portfolio of two securities with the expected return on the vertical axis and the standard deviation on the horizontal axis.If the correlation coefficient of the two securities is +1,the opportunity set will appear as which one of the following shapes?

A) conical shape

B) linear with an upward slope

C) combination of two straight lines

D) hyperbole

E) horizontal line

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

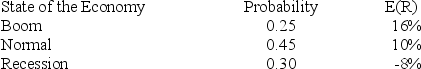

What is the variance of the returns on a security given the following information?

A) 48.18

B) 56.23

C) 64.38

D) 72.87

E) 91.35

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How will the returns on two assets react if those returns have a perfect positive correlation? I.move in the same direction II.move in opposite directions III.move by the same amount IV.move by either equal or unequal amounts

A) I and III only

B) I and IV only

C) II and III only

D) II and IV only

E) III only

G) B) and E)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Assume the returns on Stock X were positive in January,February,April,July,and November.The other months the returns on Stock X were negative.The returns on Stock Y were positive in January,April,May,July,August,and October and negative the remaining months.Which one of the following correlation coefficients best describes the relationship between Stock X and Stock Y?

A) -1.0

B) -0.5

C) 0.0

D) 0.5

E) 1.0

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own a stock that will produce varying rates of return based upon the state of the economy.Which one of the following will measure the risk associated with owning that stock?

A) weighted average return given the multiple states of the economy

B) rate of return for a given economic state

C) variance of the returns given the multiple states of the economy

D) correlation between the returns give the various states of the economy

E) correlation of the weighted average return as compared to the market

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following correlation coefficients must apply to two assets if the equally weighted portfolio of those assets creates a minimum variance portfolio that has a standard deviation of zero?

A) -1.0

B) -0.5

C) 0.0

D) 0.5

E) 1.0

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

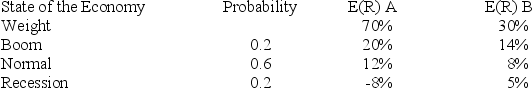

You have a portfolio which is comprised of 70 percent of stock A and 30 percent of stock B.What is the ex return on this portfolio?

A) 9.30 percent

B) 9.58 percent

C) 10.03 percent

D) 11.79 percent

E) 12.40 percent

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

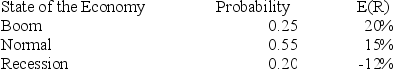

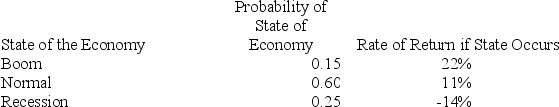

What is the expected return on this stock given the following information?

A) 9.36 percent

B) 9.74 percent

C) 10.85 percent

D) 11.78 percent

E) 12.05 percent

G) A) and E)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

What is the variance of the expected returns on this stock?

A) 18.75

B) 22.75

C) 31.53

D) 48.97

E) 50.03

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own three securities.Security A has an expected return of 11 percent as compared to 14 percent for Security B and 9 percent for Security C.The expected inflation rate is 4 percent and the nominal risk-free rate is 5 percent.Which one of the following statements is correct?

A) There is no risk premium on Security C.

B) The risk premium on Security A exceeds that of Security B.

C) Security B has a risk premium that is 50 percent greater than Security A's risk premium.

D) The risk premium on Security C is 5 percent.

E) All three securities have the same expected risk premium.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

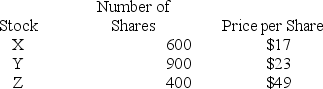

A portfolio consists of the following securities.What is the portfolio weight of stock X?

A) 0.183

B) 0.202

C) 0.219

D) 0.246

E) 0.285

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor owns a security that is expected to return 10 percent in a booming economy and 3 percent in a normal economy.The overall expected return on the security is 5.45 percent.Given there are only two states of the economy,what is the probability that the economy will boom?

A) 28 percent

B) 33 percent

C) 35 percent

D) 41 percent

E) 45 percent

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the expected return on this stock given the following information?

A) 6.40 percent

B) 6.57 percent

C) 8.99 percent

D) 13.40 percent

E) 14.25 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 88

Related Exams