A) $67,248.00

B) $8,338.75

C) $10,288.94

D) $5,860.00

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cordelia is an employee of Snaktyme Foods in Missouri.She earns $24,000 annually.Snaktyme has provided uniforms worth $350 and training worth $850 as part of her employment.She contributes 4% to her 401(k) ,of which her employer matches half.Cordelia's employer pays the following monthly amounts toward her insurance: health,$125;life,$50;AD&D,$30.Snaktyme Foods pays employer-only taxes and insurance that comprises an additional 14% of Cordelia's annual salary.What is Cordelia's total annual compensation?

A) $28,000

B) $31,500

C) $29,260

D) $32,900

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Electronic tax deposits are usually processed through the

A) AFTPS.

B) ESTPF.

C) EPS.

D) EFTPS.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

_________________________ allows firms to allocate costs accurately among departments.

A) Labor costing

B) Labor distribution

C) Compensation analysis

D) Benefit analysis

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an example of an employer's payroll-related business expense?

A) Tax deposits and filings

B) Voluntary deduction receipt

C) Tax withholding and matching

D) Employee compensation and accountability

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Patalano's Pros is a semi-weekly schedule depositor.Which forms must they file to reconcile their payroll taxes?

A) Forms 940 and 944

B) Forms 941 and 944

C) Form 944 and Schedule B

D) Form 941 and Schedule B

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jamie earns $232,000 annually.Compute the FICA taxes for both the employee and employer share.The Social Security wage base is $118,500.What is the total annual FICA tax liability for Jamie's pay?

A) $21,710

B) $19,270

C) $18,160

D) $17,872

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Mandatory employer-paid payroll taxes are known as statutory deductions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

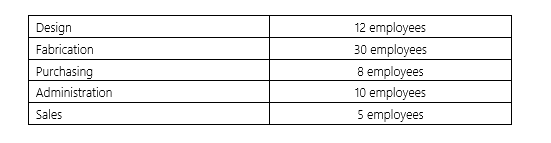

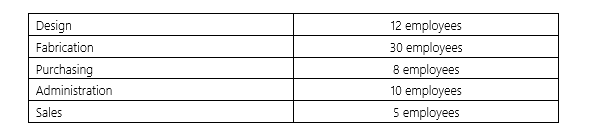

Trick's Costumes has 65 employees,who are distributed as follows:

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Fabrication department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Fabrication department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

A) $563,190.56

B) $401,173.10

C) $433,266.92

D) $481,407.69

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tasks could use data from the Benefit Analysis Report (Select all that apply) ?

A) Budgeting

B) Benchmarking

C) Departmental Reporting

D) Labor Planning

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A firm's frequency of tax deposits is determined by payroll tax liability during the lookback period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maeisha works for Brown Corporation,where she earns $45,000.Her employer contributes 1% of her pay to her pension fund and pays the following monthly amounts for her insurance: health,$300;life,$50;AD&D,$25.She receives $40 per month for her gym membership and receives a $400 bonus at the end of the year.Brown Corporation pays employer-only taxes and insurance that comprises an additional 12% of Maiesha's annual salary.What is Maeisha's total annual compensation?

A) $56,230.00

B) $54,849.30

C) $50,766.80

D) $54,451.30

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes the function of a benefit analysis report?

A) It is an analysis of the benefits paid to employees.

B) It is an analysis of each employee's benefit package.

C) It is an analysis of the effect of labor costs on departmental profitability.

D) It is an analysis of each department's benefit to the company.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total of a firm's annual wages and salaries must match on Forms _________________.

A) W-2 and W-3

B) 940 and W-2

C) W-3 and 941

D) 941 and W-2

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deschutes Companies located in Oregon has a SUTA tax rate of 4.10% and a wage base of $36,900.During the last calendar year the company paid $393,750 in wages and salaries for 11 employees.What is the total of the FUTA and SUTA tax liabilities for Deschutes Companies? (Assume that all employees have exceeded the FUTA and SUTA wage bases. )

A) $17,103.90

B) $16,709.50

C) $18,323.40.

D) $15,785.60

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An employer files Form 941 on either a quarterly basis or when they deposit payroll taxes,whichever is more frequent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

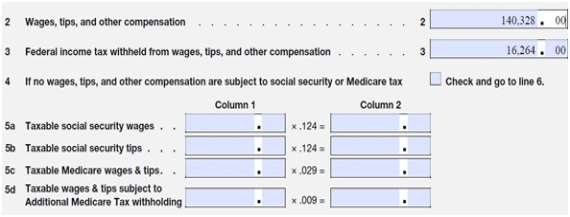

McBean Farms has the following information on their Form 941:  What amount should be entered in Column 2,Lines 5a and 5c? (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base. )

What amount should be entered in Column 2,Lines 5a and 5c? (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base. )

A) $17,400.67 and $4,069.51,respectively

B) $140,328.00

C) $8,700.34 and $2,034.76,respectively

D) $156,592

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Trick's Costumes has 65 employees,who are distributed as follows:

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does not use departmental classification,how much is allocated to each department?

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does not use departmental classification,how much is allocated to each department?

A) $153,910

B) $202,850

C) $208,610

D) $260,763

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

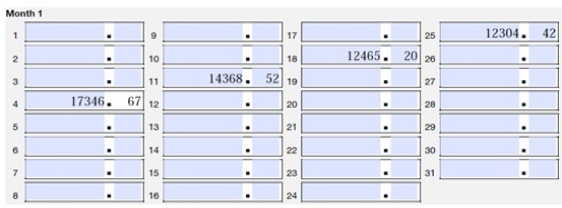

Red's Waterworks is a semiweekly depositor.One month of the recent quarter's Schedule B had the following information:  What is Red Waterworks' tax liability for Month 1?

What is Red Waterworks' tax liability for Month 1?

A) $29,811.87

B) $42,116.29

C) $56,484.81

D) $39,138.14

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Francesca earns $2,400 per pay period.Compute the FICA taxes for both employee and employer share.What is the total FICA tax liability for Francesca's pay per pay period? (Assume that Francesca has not met the FICA wage base. )

A) $297.60

B) $332.40

C) $218.40

D) $367.20

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 71

Related Exams