A) asset A

B) asset B

C) no risky asset

D) can't tell from the data given

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investor does not diversify their portfolio and instead puts all of their money in one share, the appropriate measure of security risk for that investor is the ________.

A) share's standard deviation

B) variance of the market

C) share's beta

D) covariance with the market index

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ is equal to the square root of the systematic variance divided by the total variance.

A) covariance

B) correlation coefficient

C) standard deviation

D) reward-to-variability ratio

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adding additional risky assets to the investment opportunity set will generally move the efficient frontier ________ and to the ________.

A) up, right

B) up, left

C) down, right

D) down, left

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harry Markowitz is best known for his Nobel prize-winning work on ________.

A) strategies for active securities trading

B) techniques used to identify efficient portfolios of risky assets

C) techniques used to measure the systematic risk of securities

D) techniques used in valuing securities options

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statistics cannot be negative?

A) Covariance

B) Variance

C) E[r]

D) Correlation coefficient

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

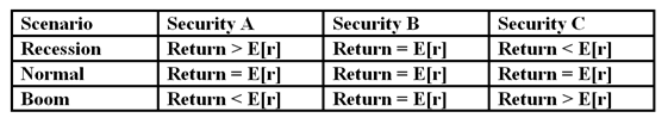

Based on the outcomes in the table below choose which of the statements is/are correct:  I. The covariance of Security A and Security B is zero

II. The correlation coefficient between Security A and C is negative

III. The correlation coefficient between Security B and C is positive

I. The covariance of Security A and Security B is zero

II. The correlation coefficient between Security A and C is negative

III. The correlation coefficient between Security B and C is positive

A) I only

B) I and II only

C) II and III only

D) I, II and III

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor can design a risky portfolio based on two shares, A and B. The standard deviation of return on Share A is 20% while the standard deviation on Share B is 15%. The correlation coefficient between the return on A and B is 0%. The standard deviation of return on the minimum variance portfolio is ________.

A) 0%

B) 6%

C) 12%

D) 17%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected rate of return of a portfolio of risky securities is ________.

A) the sum of the securities' covariances

B) the sum of the securities' variances

C) the weighted sum of the securities' expected returns

D) the weighted sum of the securities' variances

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio is composed of two shares, A and B. Share A has a standard deviation of return of 24% while Share B has a standard deviation of return of 18%. Share A comprises 60% of the portfolio while Share B comprises 40% of the portfolio. If the variance of return on the portfolio is .0380, the correlation coefficient between the returns on A and B is ________.

A) 0.583

B) 0.225

C) 0.327

D) 0.128

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As you lengthen the time horizon of your investment period and decide to invest for multiple years you will find that ________. I. the average risk per year may be smaller over longer investment horizons II. the overall risk of your investment will compound over time III. your overall risk on the investment will fall

A) I only

B) I and II only

C) III only

D) I, II and III

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Asset A has an expected return of 20% and a standard deviation of 25%. The risk-free rate is 10%. What is the reward-to-variability ratio?

A) .40

B) .50

C) .75

D) .80

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk that can be diversified away is ________.

A) beta

B) firm-specific risk

C) market risk

D) systematic risk

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Risk that can be eliminated through diversification is called ________ risk.

A) unique

B) firm-specific

C) diversifiable

D) all of the above

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor can design a risky portfolio based on two shares, A and B. Share A has an expected return of 18% and a standard deviation of return of 20%. Share B has an expected return of 14% and a standard deviation of return of 5%. The correlation coefficient between the returns of A and B is 0.50. The risk-free rate of return is 10%. The expected return on the optimal risky portfolio is ________.

A) 14.0%

B) 15.6%

C) 16.4%

D) 18.0%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to construct a riskless portfolio using two risky shares, one would need to find two shares with a correlation coefficient of ________.

A) 1.0

B) 0.5

C) 0

D) -1.0

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has a 50% chance of doubling your investment in one year and a 50% chance of losing half your money. What is the expected return on this investment project?

A) 0%

B) 25%

C) 50%

D) 75%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Decreasing the number of shares in a portfolio from 50 to 10 would likely ________.

A) increase the systematic risk of the portfolio

B) increase the unsystematic risk of the portfolio

C) increase the return of the portfolio

D) decrease the variation in returns the investor faces in any one year

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You put half of your money in a share portfolio that has an expected return of 14% and a standard deviation of 24%. You put the rest of you money in a risky bond portfolio that has an expected return of 6% and a standard deviation of 12%. The share and bond portfolio have a correlation 0.55. The standard deviation of the resulting portfolio will be ________.

A) more than 18% but less than 24%

B) equal to 18%

C) more than 12% but less than 18%

D) equal to 12%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following provides the best example of a systematic risk event?

A) A strike by union workers hurts a firm's quarterly earnings.

B) Cattle disease in Queensland hurts local farmers and buyers of beef.

C) The Reserve Bank increases interest rates 50 basis points.

D) A senior executive at a firm embezzles $10 million and escapes to South America.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 56

Related Exams