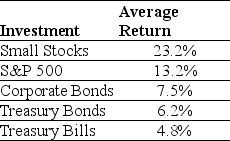

Use the table for the question(s) below.

Consider the following average annual returns:

-What is the excess return for the portfolio of small stocks?

-What is the excess return for the portfolio of small stocks?

A) 10.0%

B) 15.7%

C) 18.4%

D) 17.0%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

The excess return if the difference between the average return on a security and the average return for

A) Treasury Bonds.

B) a portfolio of securities with similar risk.

C) a broad based market portfolio like the S&P 500 index.

D) Treasury Bills.

F) A) and B)

Correct Answer

verified

Correct Answer

verified