A) A strike by union workers hurts a firm's quarterly earnings.

B) Mad Cow disease in Montana hurts local ranchers and buyers of beef.

C) The Federal Reserve increases interest rates 50 basis points.

D) A senior executive at a firm embezzles $10 million and escapes to South America.

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Asset A has an expected return of 15% and a reward-to-variability ratio of .4.Asset B has an expected return of 20% and a reward-to-variability ratio of .3.A risk-averse investor would prefer a portfolio using the risk-free asset and ______.

A) asset A

B) asset B

C) no risky asset

D) can't tell from the data given

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investing in two assets with a correlation coefficient of 1.0 will reduce which kind of risk?

A) Market risk

B) Unique risk

C) Unsystematic risk

D) With a correlation of 1.0, no risk will be reduced

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk that can be diversified away is __________.

A) beta

B) firm specific risk

C) market risk

D) systematic risk

F) C) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

You are considering adding a new security to your portfolio.In order to decide whether you should add the security you need to know the security's _______. I.expected return II.standard deviation III.correlation with your portfolio

A) I only

B) I and II only

C) I and III only

D) I, II and III

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term excess-return refers to ______________.

A) returns earned illegally by means of insider trading

B) the difference between the rate of return earned and the risk-free rate

C) the difference between the rate of return earned on a particular security and the rate of return earned on other securities of equivalent risk

D) the portion of the return on a security which represents tax liability and therefore cannot be reinvested

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Decreasing the number of stocks in a portfolio from 50 to 10 would likely _________________________.

A) increase the systematic risk of the portfolio

B) increase the unsystematic risk of the portfolio

C) increase the return of the portfolio

D) decrease the variation in returns the investor faces in any one year

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a standard deviation of return of 20%. The correlation coefficient between the returns of A and B is 0.4. The risk-free rate of return is 5%. -The proportion of the optimal risky portfolio that should be invested in stock B is approximately _________.

A) 29%

B) 44%

C) 56%

D) 71%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 18% and a standard deviation of return of 20%. Stock B has an expected return of 14% and a standard deviation of return of 5%. The correlation coefficient between the returns of A and B is 0.50. The risk-free rate of return is 10%. -The expected return on the optimal risky portfolio is _________.

A) 14.0%

B) 15.6%

C) 16.4%

D) 18.0%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has a 60% chance of doubling your investment in one year and a 40% chance of losing half your money.What is the standard deviation of this investment?

A) 25%

B) 50%

C) 62%

D) 73%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard deviation of return on investment A is .10 while the standard deviation of return on investment B is .04.If the correlation coefficient between the returns on A and B is -.50,the covariance of returns on A and B is _________.

A) -.0447

B) -.0020

C) .0020

D) .0447

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has a 50% chance of doubling your investment in one year and a 50% chance of losing half your money.What is the expected return on this investment project?

A) 0%

B) 25%

C) 50%

D) 75%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

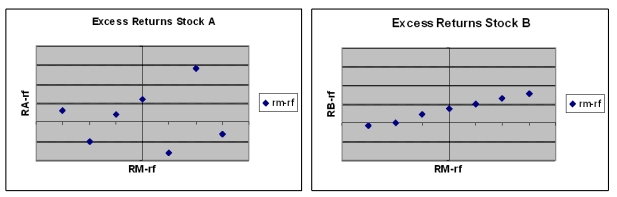

The figures below show plots of monthly excess returns for two stocks plotted against excess returns for a market index.  -Which stock is likely to further reduce risk for an investor currently holding his portfolio in a well diversified portfolio of common stock?

-Which stock is likely to further reduce risk for an investor currently holding his portfolio in a well diversified portfolio of common stock?

A) Stock A

B) Stock B

C) There is no difference between A or B

D) You cannot tell from the information given.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the most likely correlation coefficient between a stock index mutual fund and the S&P 500?

A) -1.0

B) 0.0

C) 1.0

D) 0.5

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Semitool Corp has an expected excess return of 6% for next year.However for every unexpected 1% change in the market,Semitool's return responds by a factor of 1.2.Suppose it turns out the economy and the stock market do better than expected by 1.5% and Semitool's products experience more rapid growth than anticipated,pushing up the stock price by another 1%.Based on this information what was Semitool's actual excess return?

A) 7.00%

B) 8.50%

C) 8.80%

D) 9.25%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term "complete portfolio" refers to a portfolio consisting of _________________.

A) the risk-free asset combined with at least one risky asset

B) the market portfolio combined with the minimum variance portfolio

C) securities from domestic markets combined with securities from foreign markets

D) common stocks combined with bonds

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firm specific risk is also called __________ and __________.

A) systematic risk, diversifiable risk

B) systematic risk, non-diversifiable risk

C) unique risk, non-diversifiable risk

D) unique risk, diversifiable risk

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard deviation of return on investment A is .10 while the standard deviation of return on investment B is .05.If the covariance of returns on A and B is .0030,the correlation coefficient between the returns on A and B is _________.

A) .12

B) .36

C) .60

D) .77

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

A security's beta coefficient will be negative if ____________.

A) its returns are negatively correlated with market index returns

B) its returns are positively correlated with market index returns

C) its stock price has historically been very stable

D) market demand for the firm's shares is very low

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Risk that can be eliminated through diversification is called ______ risk.

A) unique

B) firm-specific

C) diversifiable

D) all of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 84

Related Exams