A) sunk costs.

B) irrelevant costs.

C) controllable costs.

D) uncontrollable costs.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The financial statements of a merchandiser are more complex than those of a manufacturer.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The costs associated with reengineering machinery and its location within the factory to increase efficiency would be considered which element of the value chain?

A) Customer service

B) Marketing

C) Research and development

D) Design

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

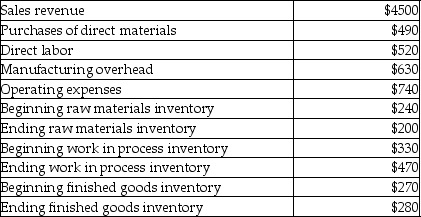

Selected financial information for Brookeville Manufacturing is presented in the following table (000s omitted) .  What was cost of goods sold?

What was cost of goods sold?

A) $1530

B) $1550

C) $1700

D) $950

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Direct materials for a company were $500,700; manufacturing overhead was $250,500; and direct labor was $770,500. Prime costs would total

A) $1,021,000.

B) $1,271,200.

C) $1,521,700.

D) $751,200.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

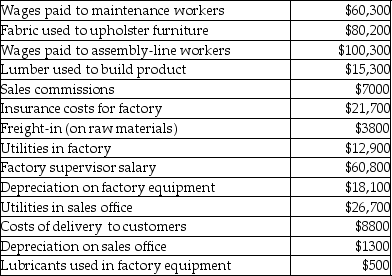

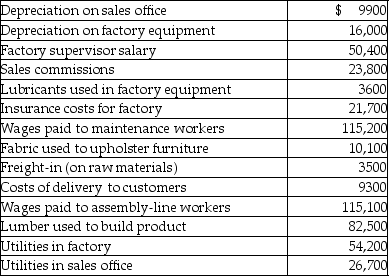

Rustic Living Furniture Company manufactures furniture at its central Kentucky factory. Some of its costs from the past year include:  Direct labor costs for Rustic Living Furniture Company totaled

Direct labor costs for Rustic Living Furniture Company totaled

A) $228,400.

B) $221,400.

C) $100,300.

D) $60,800.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Toshiba Corporation makes computer chips. Toshiba Corporation would be classified as a

A) merchandising company.

B) manufacturing company.

C) service company.

D) simple company.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

North Pacific Company used $65,000 of direct materials and incurred $43,000 of direct labor costs during the most recent year. Indirect labor amounted to $1,700 while indirect materials used totaled $1,800. Other operating costs pertaining to the factory included utilities of $4,300; maintenance of $6,800; supplies of $1,500; depreciation expense of $8,900; and property taxes of $2,400. There was no beginning or ending finished goods inventory, but work in process inventory began the year with a $6,400 balance and ended the year with a $7,800 balance. Required: Prepare a schedule of cost of goods manufactured for North Pacific Company for the year ended December 31.

Correct Answer

verified

Correct Answer

verified

True/False

The total cost of a cost object can only include the direct costs that are directly traced to that cost object.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes the way in which total fixed costs behave?

A) They will decrease as production increases.

B) They will decrease as production decreases.

C) They will remain the same throughout production levels within the relevant range.

D) They will increase as production decreases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rent on a factory building would be considered to be a ________ cost.

A) product

B) period

C) direct

D) none of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

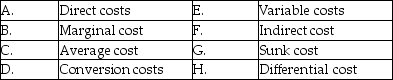

On the line in front of each statement, enter the letter corresponding to the term that best fits that statement. You may use a letter more than once and some letters may not be used at all.

________ The total cost divided by the total volume.

________ The difference in cost between two alternative courses of action.

________ The combination of direct labor and manufacturing overhead costs.

________ The cost of producing one more unit.

________ Costs that can be traced to the cost object.

________ The total cost divided by the total volume.

________ The difference in cost between two alternative courses of action.

________ The combination of direct labor and manufacturing overhead costs.

________ The cost of producing one more unit.

________ Costs that can be traced to the cost object.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

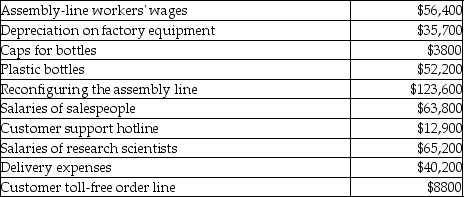

Joe's Bottling Company provided the following expense information for July:  What is the total cost for the production category of the value chain?

What is the total cost for the production category of the value chain?

A) $462,600

B) $310,000

C) $148,800

D) $148,100

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To forecast total costs at a given level of production, management would use which of the following calculations?

A) Average cost × total units predicted

B) Total fixed cost × total units predicted

C) Total fixed cost + (variable cost per unit × total units predicted)

D) Total fixed cost + variable cost per unit

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Period costs are

A) always recorded as an expense.

B) always considered part of the inventory.

C) expensed only when the inventory is sold.

D) none of the above.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How do fixed costs per unit behave?

A) They remain the same throughout production levels within the relevant range.

B) They decrease as production decreases.

C) They increase as production decreases.

D) They increase as production increases.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Controlling costs across the whole value chain often requires a trade-off between the individual elements of the value chain.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Country Furniture Company manufactures furniture at its Akron, Ohio, factory. Some of its costs from the past year include:  Direct labor costs for Country Furniture Company totaled

Direct labor costs for Country Furniture Company totaled

A) $304,500.

B) $115,200.

C) $115,100.

D) $280,700.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a company wants to determine a product's cost, it must assign both direct and indirect costs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A marginal cost is the cost of making one more unit of a product.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 318

Related Exams