B) False

Correct Answer

verified

Correct Answer

verified

Essay

Real Losers, a diet magazine, collected $360,000 in subscription revenue in May. Each subscriber will receive an issue of the magazine for each of the next 12 months, beginning with the June issue. The company uses the accrual method of accounting. What adjusting entry is needed at June 30?

Correct Answer

verified

Correct Answer

verified

Essay

A business pays its employees' monthly salaries of $20,000, half on the 15th day of each month, and half on the first day of the following month. On October 31, the business accrued salaries for the second half of October. On November 1, the business paid their employees $10,000 for the second half of October. Please provide the journal entry for the payment made on November 1.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts would NOT be included in the adjusting entries made at the end of an accounting period?

A) Accounts receivable

B) Accounts payable

C) Cash

D) Prepaid insurance

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Classic Artists' Services has hired a maintenance man to maintain a building they use for instruction. He will begin work on February 1 and work through till May 31. They will pay the maintenance man $2,000 at the end of May. Classic Artists' Services accrue Maintenance expense at the end of every month. What is the balance in the Accounts payable account for amounts owed to the maintenance man at the end of March?

A) Debit balance of $2,000

B) Credit balance of $1,000

C) Debit balance of $1,000

D) Credit balance of $2,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How do the adjusting entries differ from other journal entries?

A) Adjusting entries always include debits or credits to at least one income statement account and at least one balance sheet account.

B) Adjusting entries are made only at the end of the period.

C) Adjusting entries never affect cash.

D) All of the above are true.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adjusting entries NEVER involve:

A) expenses.

B) cash.

C) liabilities.

D) revenues.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Employees of Robert Rogers, CPA worked during the last two weeks of December. They received their paychecks on January 2. The matching principle would require that which of the following accounts appear on the balance sheet for December 31?

A) Accounts payable

B) Salaries payable

C) Salary expense

D) Prepaid expense

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the current year, the accountant for Navistar Graphics forgot to make an adjusting entry to accrue Wages payable to the company's employees for the last week in December. The wages will be paid to the employees in January. Which of the following is one of the effects of this error?

A) Net income is overstated.

B) Liabilities are overstated.

C) Net income is understated.

D) Expenses are overstated.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

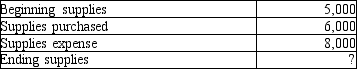

The table below represents Able Company's supplies account. Please supply the missing amount.

A) $9,000

B) $1,000

C) $3,000

D) $11,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accountant for Barnes Architectural Services failed to make an adjusting entry to record $7,000 of depreciation expense. Which of the following is TRUE?

A) Total liabilities are overstated.

B) Total liabilities are understated.

C) Total assets are overstated.

D) Total assets are understated.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The financial statements should be prepared in this order: 1)income statement, 2)balance sheet, and 3)owner's equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accountant for Wilson Consulting Company failed to make an adjusting entry to record $3,000 of unearned service revenue that has now been earned. Which of the following is TRUE?

A) Total revenue is overstated.

B) Total revenue is understated.

C) Total expenses are overstated.

D) Total expenses are understated.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Generally accepted accounting principles require the use of accrual accounting.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accountant for Duman Legal Services failed to make an adjusting entry for supplies that had been used for the year. Which of the following is TRUE?

A) Total liabilities are overstated.

B) Total liabilities are understated.

C) Total assets are overstated.

D) Total assets are understated.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

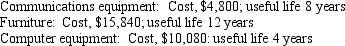

Hank's Tax Planning Service has the following plant assets:

Hank's monthly depreciation entry will include a:

A)debit to depreciation expense of $210.

B)credit to depreciation expense of $370.

C)debit to Accumulated Depreciation of $210.

D)credit to Accumulated Depreciation of $370.

Hank's monthly depreciation entry will include a:

A)debit to depreciation expense of $210.

B)credit to depreciation expense of $370.

C)debit to Accumulated Depreciation of $210.

D)credit to Accumulated Depreciation of $370.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

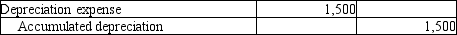

On December 31, 2012, the adjusting entry for depreciation was made incorrectly. The following is the entry which was made erroneously:  The correct amount of depreciation should have been $5,100. Consider the effects of this error on the balance sheet, and identify which of the following statements is TRUE.

The correct amount of depreciation should have been $5,100. Consider the effects of this error on the balance sheet, and identify which of the following statements is TRUE.

A) Total liabilities are overstated by $3,600.

B) Total liabilities are understated by $3,600.

C) Total assets are overstated by $3,600.

D) Total assets are understated by $3,600.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accountant for Hobson Electrical Repair Company failed to make an adjusting entry to record $5,000 of unpaid salaries for the last two weeks of the year. Which of the following is TRUE?

A) Total liabilities are overstated.

B) Total liabilities are understated.

C) Total assets are overstated.

D) Total assets are understated.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On September 1, 2011, Joy Company paid $4,000 in advance for an 8-month rental space covering the period of September, 2011 through April, 2012. The business makes adjusting entries once a year at year-end. The adjusting entry at December 31, 2011 would include a:

A) debit of $4,000 to Prepaid rent expense on December 31, 2011.

B) debit of $2,000 to Prepaid rent expense on December 31, 2011.

C) debit of $2,000 to Rent expense on December 31, 2011.

D) credit of $2,000 to Rent expense on December 31, 2011.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Real Losers, a diet magazine, collected $360,000 in subscription revenue in May. Each subscriber will receive an issue of the magazine for each of the next 12 months, beginning with the June issue. The company uses the accrual method of accounting. What is the balance in the Unearned revenue account at the end of December?

A) $150,000

B) $330,000

C) $360,000

D) $0

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 160

Related Exams