A) Costs in service organizations are typically tracked by customer rather than product.

B) Account names for service organizations are slightly different from those used by manufacturers.

C) Service organizations tend to use fewer materials.

D) The process of tracking labor for service organizations is completely different from the process used by manufacturers.

E) None of the answer choices is correct.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The law firm,Keen and Sholer,assigns overhead to clients based on direct labor hours using normal costing.During June,they compiled the following information regarding hours worked and costs: Actual direct labor hours 900 hours Actual overhead costs $7,200 Estimated direct labor hours 1,000 hours Estimated overhead costs $9,000 The amount of applied overhead for June is:

A) $8,100

B) $7,200

C) $6,480

D) $9,000

E) None of the answer choices is correct.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The overhead costs applied to jobs using a predetermined overhead rate are recorded by debiting Work in Process Inventory and crediting Manufacturing Overhead.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kaplan Inc.applies overhead on the basis of direct labor hours.During 2012,the predetermined overhead rate used was $9.00.If overhead was underapplied by $16,500 during 2012,which of the following would not be a reason for the underapplied overhead?

A) Estimated direct labor hours differed from actual direct labor hours.

B) Applied overhead was lower than actual overhead.

C) Estimated overhead costs differed from actual overhead costs.

D) Applied overhead was higher than actual overhead.

E) None of the answer choices is correct.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Process costing is best described by which statement?

A) Only direct materials and manufacturing overhead are assigned to products under process costing.

B) Units produced in a process costing system are unique and are produced individually.

C) Product costs are tracked by department and assigned to products passing through each department.

D) There cannot be any beginning or ending Work in Process Inventory with process costing.

E) None of the answer choices is correct.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a manufacturing company purchases raw materials,the Raw Materials Inventory account is debited.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Work in Process Inventory account for Baja Manufacturing Company shows a balance of $7,200 at the end of the accounting period.The job cost sheets of the only two uncompleted jobs,Jobs 4 and 7,show respective charges of $2,400 and $1,200 for direct materials used.Jobs 4 and 7 also show respective charges of $1,600 and $800 for direct labor used.Based on this information,what is the predetermined overhead rate as a percentage of direct labor costs that Morris is using?

A) 200%

B) 50%

C) 33.3%

D) 16.7%

E) None of the answer choices is correct.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

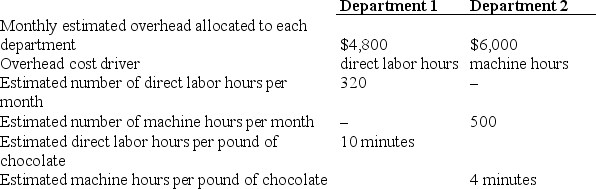

Specialty Chocolates recently expanded its operations beyond its existing kitchen to serve its retail operations by establishing a new kitchen to serve a wholesale market for local specialty shops.With this new arrangement,Specialty Chocolates will continue to have a retail shop attached to its original kitchen (Department 1) and the new wholesale operations shipping out of the new kitchen (Department 2) .Using normal costing,the company applies monthly overhead using predetermined overhead rates based on direct labor hours for the older operation in Department 1 and machine hours for overhead rates in the more automated Department 2.

Given this information,what are the respective overhead application rates to be used per pound of chocolate for Departments 1 and 2?

Given this information,what are the respective overhead application rates to be used per pound of chocolate for Departments 1 and 2?

A) Department 1: $1.50 per pound;Department 2: $0.20 per pound.

B) Department 1: $0.25 per pound;Department 2: $0.20 per pound.

C) Department 1: $2.50 per pound;Department 2: $0.80 per pound.

D) Department 1: $0.25 per pound;Department 2: $2.00 per pound.

E) None of the answer choices is correct.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is typically used as a subsidiary ledger for Work in Process in a job cost system?

A) Job cost sheet.

B) Balance sheet.

C) Materials requisition.

D) Timesheet.

E) None of the answer choices is correct.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When direct materials are transferred into production,the journal entry includes a debit to the Work in Process Inventory account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Service organizations often use a predetermined overhead rate similar to manufacturing companies.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following companies would probably not use job order costing?

A) A window washing service.

B) A milk manufacturer.

C) A car repair business.

D) An electrician.

E) None of the answer choices is correct.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goodman Company has $30,000 in underapplied overhead,which is considered by the company to be a material amount.Other account balances include: Work in Process Inventory $140,000 Finished Goods Inventory 40,000 Cost of Goods Sold 20,000 Which one of the following would be the correct journal entry for closing the underapplied overhead?

A) Work in Process Inventory 21,000

Finished Goods Inventory 6,000

Cost of Goods Sold 3,000

Manufacturing Overhead 30,000

B) Manufacturing Overhead 30,000

Work in Process Inventory 21,000

Finished Goods Inventory 6,000

Cost of Goods Sold 3,000

C) Manufacturing Overhead 30,000

Work in Process Inventory 10,000

Finished Goods Inventory 10,000

Cost of Goods Sold 10,000

D) Work in Process Inventory 10,000

Finished Goods Inventory 10,000

Cost of Goods Sold 10,000

Manufacturing Overhead 30,000

E) None of the answer choices is correct.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adams Company placed $2,000 of direct materials into production.Which one of the following journal entries should Jones record for this transaction?

A) Raw Materials Inventory 2,000

Accounts Payable 2,000

B) Work in Process Inventory 2,000

Manufacturing Overhead 2,000

C) Manufacturing Overhead 2,000

Raw Materials Inventory 2,000

D) Work in Process Inventory 2,000

Raw Materials Inventory 2,000

E) None of the answer choices is correct.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the requisition of indirect materials in a job cost system includes a:

A) debit to Work in Process Inventory.

B) debit to Manufacturing Overhead.

C) credit to Accounts Payable.

D) credit to Work in Process Inventory.

E) None of the answer choices is correct.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Underapplied overhead occurs when actual overhead costs are lower than overhead costs applied to jobs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record depreciation on the factory building should include a:

A) debit to Work in Process Inventory.

B) debit to Manufacturing Overhead.

C) debit to Cost of Goods Sold.

D) credit to Work in Process Inventory.

E) None of the answer choices is correct.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are reasons that managers track revenues and costs using a job costing system except:

A) Managers use the information to record product costs as period costs.

B) Managers want to know if individual jobs are profitable.

C) Managers compare actual costs with estimated costs throughout the project to identify unexpected changes as early as possible.

D) Managers assess the accuracy of original cost estimates.

E) None of the answer choices is correct.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using a job cost system,which of the following will not appear on a job cost sheet?

A) Direct labor.

B) Direct materials.

C) Actual manufacturing overhead incurred.

D) Manufacturing overhead applied.

E) None of the answer choices is correct.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record wages owed to the production supervisor should include a debit to:

A) Wages Payable.

B) Wages Expense.

C) Work in Process Inventory.

D) Manufacturing Overhead.

E) None of the answer choices is correct.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 44

Related Exams