A) Issuing bonds; selling investments.

B) Purchasing land; repaying a bank loan.

C) Receiving cash from the sale of inventory; paying cash dividends.

D) Purchasing treasury stock; lending cash to an employee.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Using the direct method we adjust the items on the income statement to directly show the cash inflows and outflows from operations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The collection of cash from customers would be classified as which type of cash flow on the Statement of Cash Flows?

A) Financing.

B) Investing.

C) Operating.

D) Not reported on the statement of cash flows.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kela Corporation reports net income of $450,000 that includes depreciation expense of $70,000. Also, cash of $50,000 was borrowed on a 5-year note payable. Based on this data, total cash inflows from operating activities are:

A) $380,000.

B) $470,000.

C) $520,000.

D) $570,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Micro Manufacturing reports net income of $850,000. Depreciation Expense is $60,000, Accounts Receivable increases $30,000 and Accounts Payable decreases $10,000. Calculate net cash flows from operating activities using the indirect method.

Correct Answer

verified

Correct Answer

verified

True/False

Under the indirect method, a decrease in accounts receivable is added to net income to arrive at net cash flows from operating activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allen Company's income statement reported total revenues, $850,000 and total expenses (including $40,000 depreciation) of $720,000. The balance sheet reported the following: Accounts Receivable-beginning balance, $50,000 and ending balance, $60,000; Accounts Payable-beginning balance, $22,000 and ending balance, $28,000. Therefore, based only on this information, the net cash inflows from operating activities were:

A) $126,000.

B) $166,000.

C) $174,000.

D) $186,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

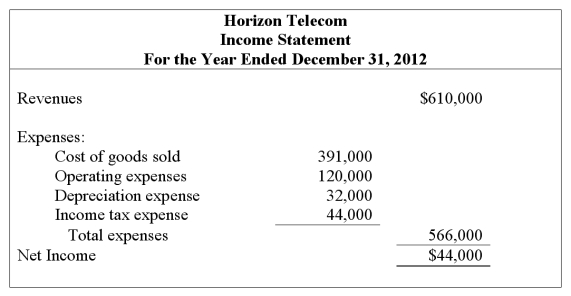

Portions of the financial statements for Horizon Telecom are provided below.  Prepare the operating activities section of the statement of cash flows for Horizon Telecom using the direct method.

Prepare the operating activities section of the statement of cash flows for Horizon Telecom using the direct method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bad Brad's would report net cash inflows (outflows) from financing activities in the amount of:

A) $1,100.

B) $(1,100) .

C) $820.

D) $900.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Electronic Wonders reports net income of $95,000. The accounting records reveal Depreciation Expense of $50,000 as well as increases in Prepaid Rent, Accounts Payable, and Income Tax Payable of $40,000, $23,000, and $20,000, respectively. Prepare the operating activities section of Electronic Wonders' statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 150 of 150

Related Exams