A) The asset demand for money is $3,200 billion

B) The total demand for money is $4,800 billion

C) On average, each dollar will be spent five times a year

D) The supply of money needs to be increased to meet the demand

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Federal Reserve raises the target Federal funds rate, it:

A) Sells government securities to increase the excess reserves available for overnight loan

B) Buys government securities to increase the excess reserves available for overnight loan

C) Sells government securities to decrease the excess reserves available for overnight loan

D) Buys government securities to decrease the excess reserves available for overnight loan

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

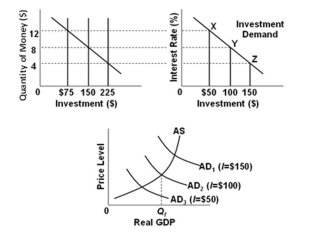

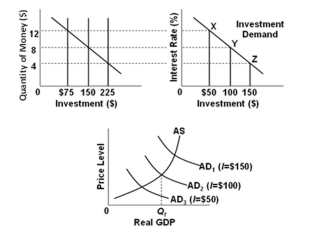

Refer to the graphs above, in which the numbers in parentheses near the AD1, AD2, and AD3 labels indicate the level of investment spending associated with each curve. All figures are in billions. The economy is at point Y on the investment demand curve. Given these conditions, what policy should the Fed pursue to achieve a noninflationary full-employment level of real GDP?

Refer to the graphs above, in which the numbers in parentheses near the AD1, AD2, and AD3 labels indicate the level of investment spending associated with each curve. All figures are in billions. The economy is at point Y on the investment demand curve. Given these conditions, what policy should the Fed pursue to achieve a noninflationary full-employment level of real GDP?

A) Increase aggregate demand from AD3 to AD2

B) Decrease the money supply from $225 to $150 billion

C) Increase interest rates from 4 to 8 percent

D) Make no change in monetary policy

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

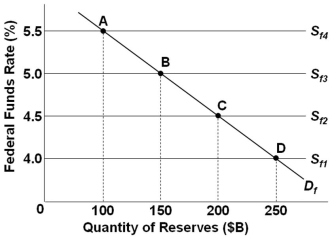

In a supply-and-demand graph for the Federal funds market, the demand curve is downward-sloping because:

A) Higher rates give banks less incentive to lend to other banks

B) Higher rates give banks more incentive to borrow reserves

C) Lower rate give banks less incentive to borrow reserves

D) Lower rates give banks more incentive to borrow reserves

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

There is an asset demand for money because households and business firms use money as a store of value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compared to fiscal policy, monetary policy has a much shorter:

A) Recognition lag

B) Administrative lag

C) Operational lag

D) Effects lag

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a monetary policy intended to rein in inflation?

A) Increase the money supply to shift the aggregate demand curve rightward

B) Reduce interest rates to increase investment spending

C) Reduce the interest paid on banks' reserves

D) Decrease the money supply to shift the aggregate demand curve leftward

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A bond with no expiration date is priced at $10,000 when the interest rate in the economy is 6%. If the interest rate falls to 5.5%, then this bond's price would decrease.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following Fed actions increases the excess reserves of commercial banks?

A) Selling bonds to the public

B) Selling bonds to commercial banks

C) Increasing the discount rate

D) Lower the reserve ratio

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

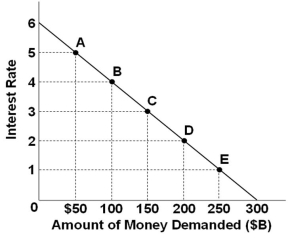

Refer to the graph above. If the supply of money was $200 billion, the interest rate would be:

Refer to the graph above. If the supply of money was $200 billion, the interest rate would be:

A) 1 percent

B) 2 percent

C) 3 percent

D) 4 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the graphs above, in which the numbers in parentheses near the AD1, AD2, and AD3 labels indicate the levels of investment spending associated with each curve. All figures are in billions. A shift in the aggregate demand curve from AD3 to AD2 can be achieved by Federal Reserve action to:

Refer to the graphs above, in which the numbers in parentheses near the AD1, AD2, and AD3 labels indicate the levels of investment spending associated with each curve. All figures are in billions. A shift in the aggregate demand curve from AD3 to AD2 can be achieved by Federal Reserve action to:

A) Increase the reserve ratio

B) Increase the discount rate

C) Buy government securities in the open market

D) Sell government securities in the open market

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the figure above. If the Federal funds market is at equilibrium at point B and the Federal Reserve decides to change the rate by a percentage point in order to reduce the chances of the economy going into recession, the supply of funds curve will have to shift to:

Refer to the figure above. If the Federal funds market is at equilibrium at point B and the Federal Reserve decides to change the rate by a percentage point in order to reduce the chances of the economy going into recession, the supply of funds curve will have to shift to:

A) Sf1

B) Sf2

C) Sf3

D) Sf4

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fundamental objective of monetary policy is to assist the economy in achieving:

A) A rapid pace of economic growth

B) A money supply which is based on the gold standard

C) A full-employment, noninflationary level of total output

D) A balanced-budget consistent with full-employment

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If nominal GDP is $800 billion and, on average, each dollar is spent four times in the economy over a year, then the quantity of money demanded for transactions purposes will be:

A) $200 billion

B) $400 billion

C) $800 billion

D) $3,200 billion

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 174 of 174

Related Exams