B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true for a company that uses variable costing?

A) The unit product cost changes as a result of changes in the number of units manufactured.

B) Both variable selling costs and variable production costs are included in the unit product cost.

C) Net operating income moves in the same direction as sales.

D) Net operating income is greatest in periods when production is highest.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

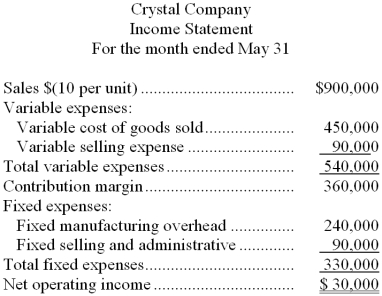

Crystal Company produces a single product. The company's variable costing income statement for the month of May appears below:  The company produced 80,000 units in May and the beginning inventory consisted of 25,000 units. Variable production costs per unit and total fixed costs have remained constant over the past several months.

-The dollar value of the company's inventory on May 31 under the absorption costing method would be:

The company produced 80,000 units in May and the beginning inventory consisted of 25,000 units. Variable production costs per unit and total fixed costs have remained constant over the past several months.

-The dollar value of the company's inventory on May 31 under the absorption costing method would be:

A) $120,000

B) $90,000

C) $75,000

D) $60,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Silver Company produces a single product. Last year, the company's variable production costs totaled $7,500 and its fixed manufacturing overhead costs totaled $4,500. The company produced 3,000 units during the year and sold 2,400 units. There were no units in the beginning inventory. Which of the following statements is true?

A) Under variable costing, the units in the ending inventory will be costed at $4 each.

B) The net operating income under absorption costing for the year will be $900 lower than the net operating income under variable costing.

C) The ending inventory under variable costing will be $900 lower than the ending inventory under absorption costing.

D) Under absorption costing, the units in ending inventory will be costed at $2.50 each.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

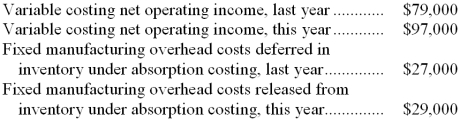

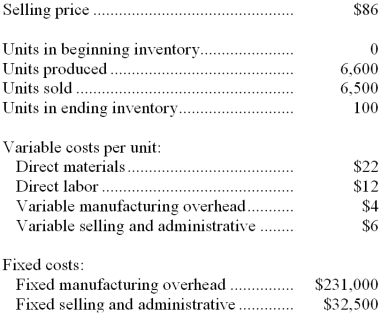

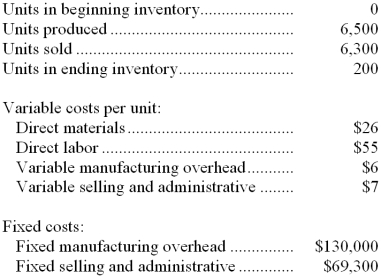

Boyar Corporation manufactures a variety of products. The following data pertain to the company's operations over the last two years:  Required:

a. Determine the absorption costing net operating income last year. Show your work!

b. Determine the absorption costing net operating income this year. Show your work!

Required:

a. Determine the absorption costing net operating income last year. Show your work!

b. Determine the absorption costing net operating income this year. Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

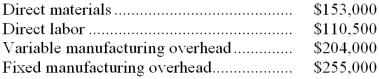

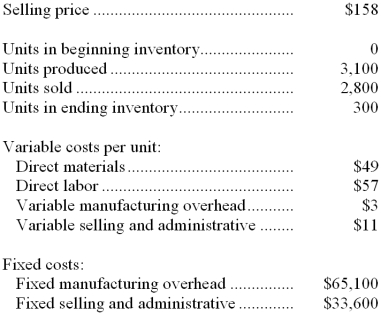

Harris Company produces a single product. Last year, Harris manufactured 17,000 units and sold 13,000 units. Production costs for the year were as follows:  Sales were $780,000 for the year, variable selling and administrative expenses were $88,400, and fixed selling and administrative expenses were $170,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-The contribution margin per unit was:

Sales were $780,000 for the year, variable selling and administrative expenses were $88,400, and fixed selling and administrative expenses were $170,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-The contribution margin per unit was:

A) $17.50

B) $32.50

C) $27.30

D) $25.70

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Profits move in the same direction as sales when variable costing is used if selling prices, the sales mix, and the cost structure remain the same.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Slovick Inc., which produces a single product, has provided the following data for its most recent month of operations:  There were no beginning or ending inventories.

-The unit product cost under absorption costing was:

There were no beginning or ending inventories.

-The unit product cost under absorption costing was:

A) $161

B) $199

C) $262

D) $168

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year, Wardrup Corporation's variable costing net operating income was $67,200. Fixed manufacturing overhead costs released from inventory under absorption costing amounted to $600. What was the absorption costing net operating income last year?

A) $67,800

B) $66,600

C) $67,200

D) $600

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dearman Company, which has only one product, has provided the following data concerning its most recent month of operations:  -What is the total period cost for the month under the variable costing approach?

-What is the total period cost for the month under the variable costing approach?

A) $98,700

B) $64,400

C) $65,100

D) $129,500

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When reconciling variable costing and absorption costing net operating income, fixed manufacturing overhead costs released from inventory under absorption costing should be deducted from variable costing net operating income to arrive at the absorption costing net operating income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

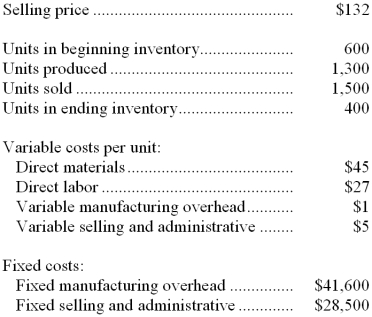

Jarmon Company, which has only one product, has provided the following data concerning its most recent month of operations:  The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.

-What is the net operating income for the month under variable costing?

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.

-What is the net operating income for the month under variable costing?

A) $4,500

B) $10,900

C) $25,500

D) $12,800

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

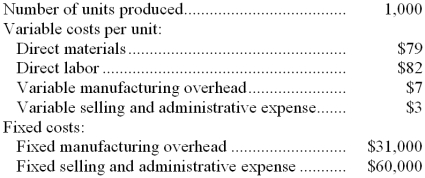

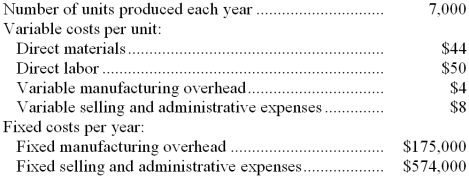

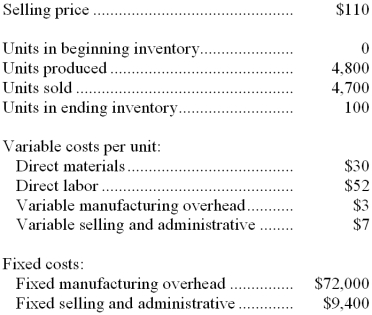

Mascioli Corporation produces a single product and has the following cost structure:  Required:

Compute the unit product cost under variable costing. Show your work!

Required:

Compute the unit product cost under variable costing. Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

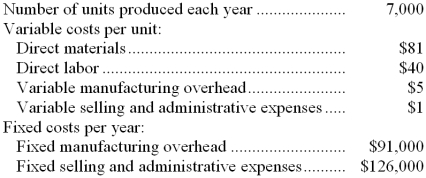

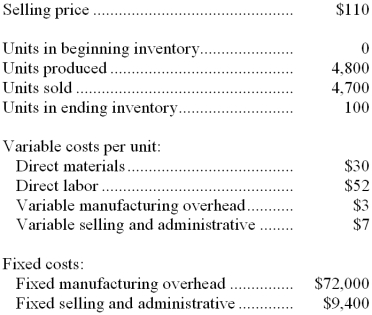

Mcgougan Corporation produces a single product and has the following cost structure:  -The unit product cost under absorption costing is:

-The unit product cost under absorption costing is:

A) $126

B) $158

C) $139

D) $121

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

Cardwell Corporation manufactures a variety of products. Last year, the company's variable costing net operating income was $63,900 and ending inventory increased by 900 units. Fixed manufacturing overhead cost per unit was $3. Required: Determine the absorption costing net operating income for last year. Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Abdol Company, which has only one product, has provided the following data concerning its most recent month of operations:  -The total gross margin for the month under the absorption costing approach is:

-The total gross margin for the month under the absorption costing approach is:

A) $13,000

B) $91,800

C) $273,000

D) $84,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the absorption costing unit product cost for the month?

What is the absorption costing unit product cost for the month?

A) $107

B) $94

C) $87

D) $114

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hackney Company, which has only one product, has provided the following data concerning its most recent month of operations:  -What is the net operating income for the month under variable costing?

-What is the net operating income for the month under variable costing?

A) $4,700

B) $(5,300)

C) $1,500

D) $3,200

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hackney Company, which has only one product, has provided the following data concerning its most recent month of operations:  -What is the total period cost for the month under the variable costing approach?

-What is the total period cost for the month under the variable costing approach?

A) $42,300

B) $81,400

C) $114,300

D) $72,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Direct labor is always considered to be a product cost under variable costing.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 136

Related Exams