The net realizable value of accounts receivable decreases when an account receivable is written off.

B) False

Correct Answer

verified

Correct Answer

verified

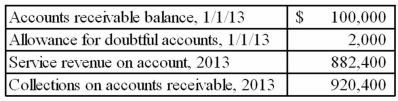

The following information is available for Kettler Company, which uses the allowance method of accounting for uncollectible accounts.  Kettler estimated that 1% of sales on account will be uncollectible. After several attempts at collection, Kettler wrote off an account of $440 that could not be collected.

Required: Prepare journal entries for the following events:

a) 2013 service revenue

b) 2013 collections on account

c) Write-off of the uncollectible account

d) Uncollectible accounts expense for 2013

Kettler estimated that 1% of sales on account will be uncollectible. After several attempts at collection, Kettler wrote off an account of $440 that could not be collected.

Required: Prepare journal entries for the following events:

a) 2013 service revenue

b) 2013 collections on account

c) Write-off of the uncollectible account

d) Uncollectible accounts expense for 2013

Correct Answer

verified

Correct Answer

verified